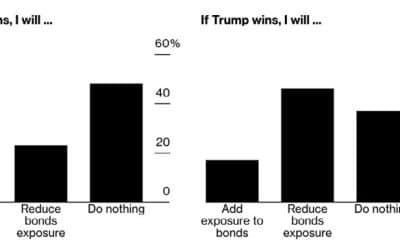

The past year has brought not only huge market swings between risk-on and risk-off phases but also a staggering divergence of returns between regions and investment styles. In equities, much of this can be explained by sector performance. The outlook for inflation is not yet strong enough for the sector rotation of November and December to have continued at the same rate in January but many investors are expecting the recent recovery of cyclical/value shares (consumer cyclicals, energy, industrials and financials) to continue and the valuation gap to close.

Last year, it was a COVID-19-determined market, with sectors that benefited from the pandemic doing well and those that didn’t having a torrid year. The best performing sectors included tech shares, consumer defensives, basic materials, freight and logistics and homeware. The worst performers were oil and gas, financial services (banks), retail estate and airlines. In its 2021 Global Outlook, Blackrock has divided companies into three categories based on its bottom-up analysis: those in trouble that may fall further, those that that are hurt but should recover and companies that are strong and could get stronger. It sees airlines in the first bucket because business travellers account for a disproportionate share of profits and expects that companies will wish to continue benefiting from the cost savings made by holding events virtually.

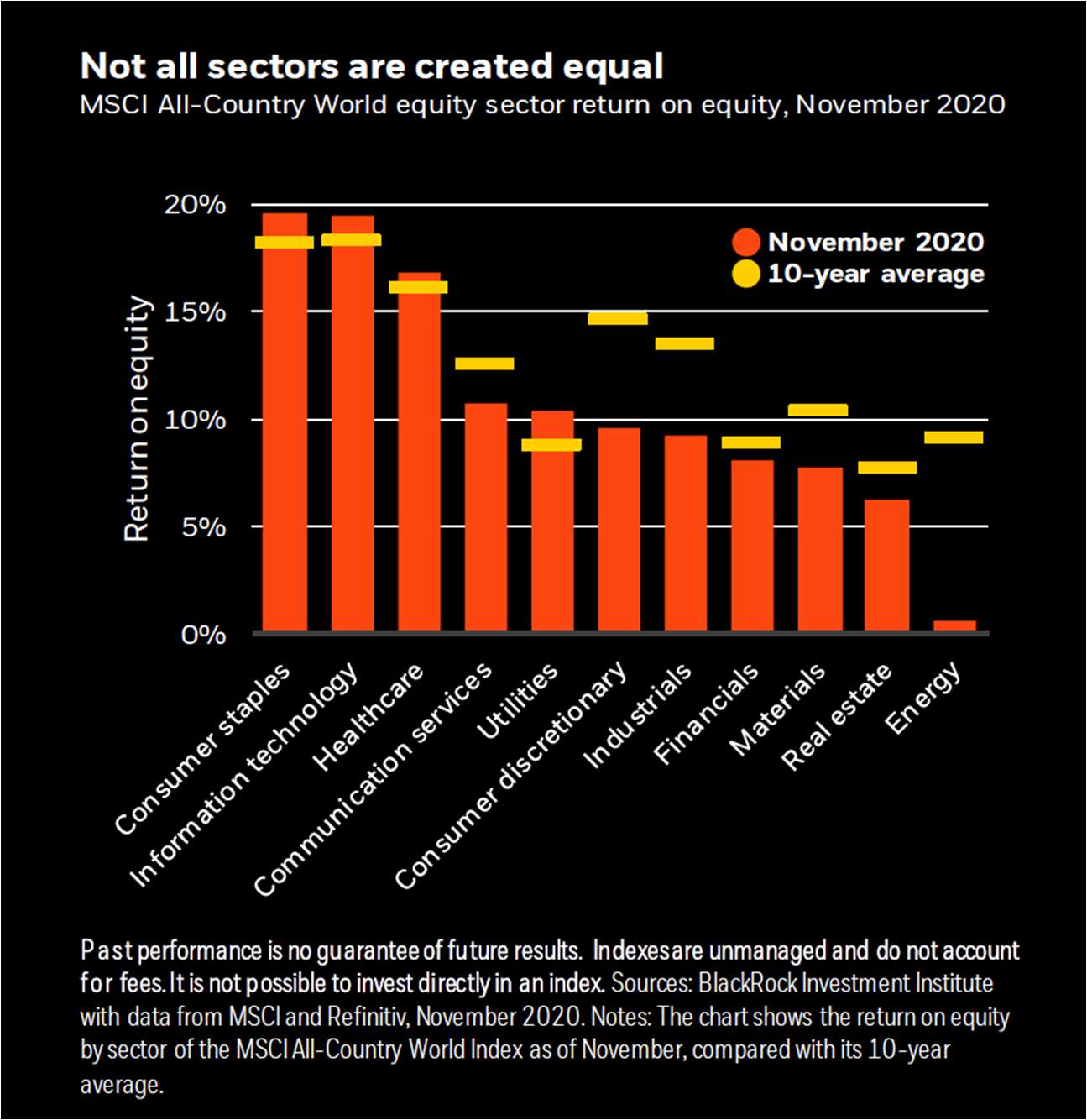

Housing, materials and autos fall into its middle bucket as the interest rate-sensitive parts of the US economy are already recovering strongly. It puts tech is in the third category as it leverages accelerated trends, offers scarce growth amid rock-bottom yields and boasts high profit margins. The graph below captures the state of play in the sectors towards the end of last year:

Impact of sector weightings on unconstrained indices

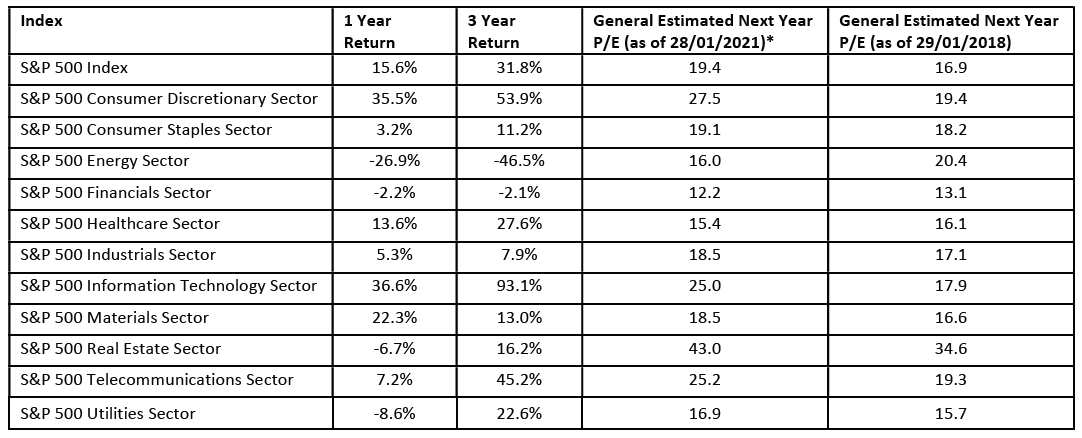

Changes in sector performance over time impact weighting within indices and index performance. For the S&P500 index metrics such as price-to- sales and price-to-earnings are often quoted as evidence of overvaluation but it is important to consider the impact of the high weighting now attributed to mega-cap tech stocks. These stocks are generally more highly rated, at least partly justified by high earnings and cash flow, so as the share prices have rallied it is only natural that the P/E and P/S ratios of the S&P 500 have risen. The table below generated by DB shows sectoral PE ratios and demonstrates how shifts in sector performance can move index-level valuations. It is worth noting a theoretical scenario where the ratios applied to an index could rise without it being the case for any individual sector, purely due to sector performance divergence.  *based on earnings estimates for 2022

*based on earnings estimates for 2022

A new battleground between the US and China

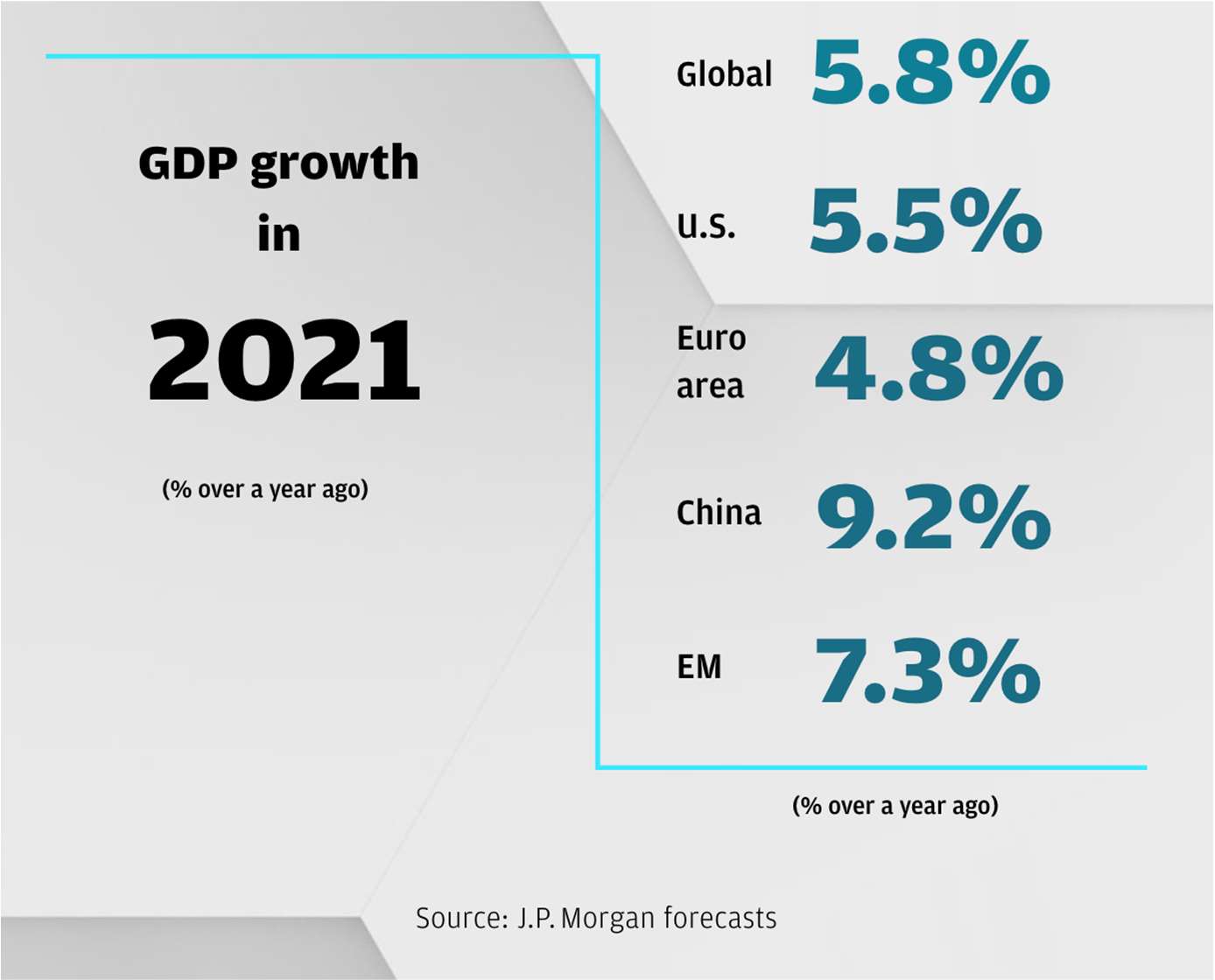

This year, another key driver of financial markets is expected to be the relationship between the US and China. Although Joe Biden is likely to take a less confrontational approach than his predecessor, both countries are likely to seek self- sufficiency in critical industries. We continue to ensure that strategies contain diversified exposure to both poles of growth. As China opens up its capital markets to global investors, the spotlight may switch from the bilateral trade deficit to climate and human rights. We are also beginning to reflect this shift in exposure. The pandemic continues to wreak havoc in many parts of the world and expectations of short-term economic performance have weakened. Furthermore, vaccines now appear not quite the silver bullet hoped for when it comes to opening up the global economy while supply constrains rollouts and the effectiveness against virus mutations remains uncertain. Many commentators, including JP Morgan, still expect strong, back-end-loaded global growth this year and tailwinds continuing to underpin stock markets in a yield-starved world. Nonetheless, we remain risk-conscious and prepared for all eventualities.

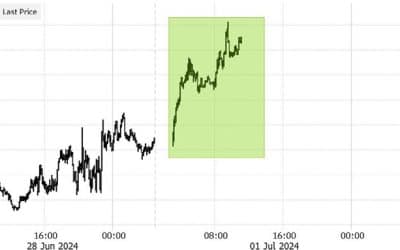

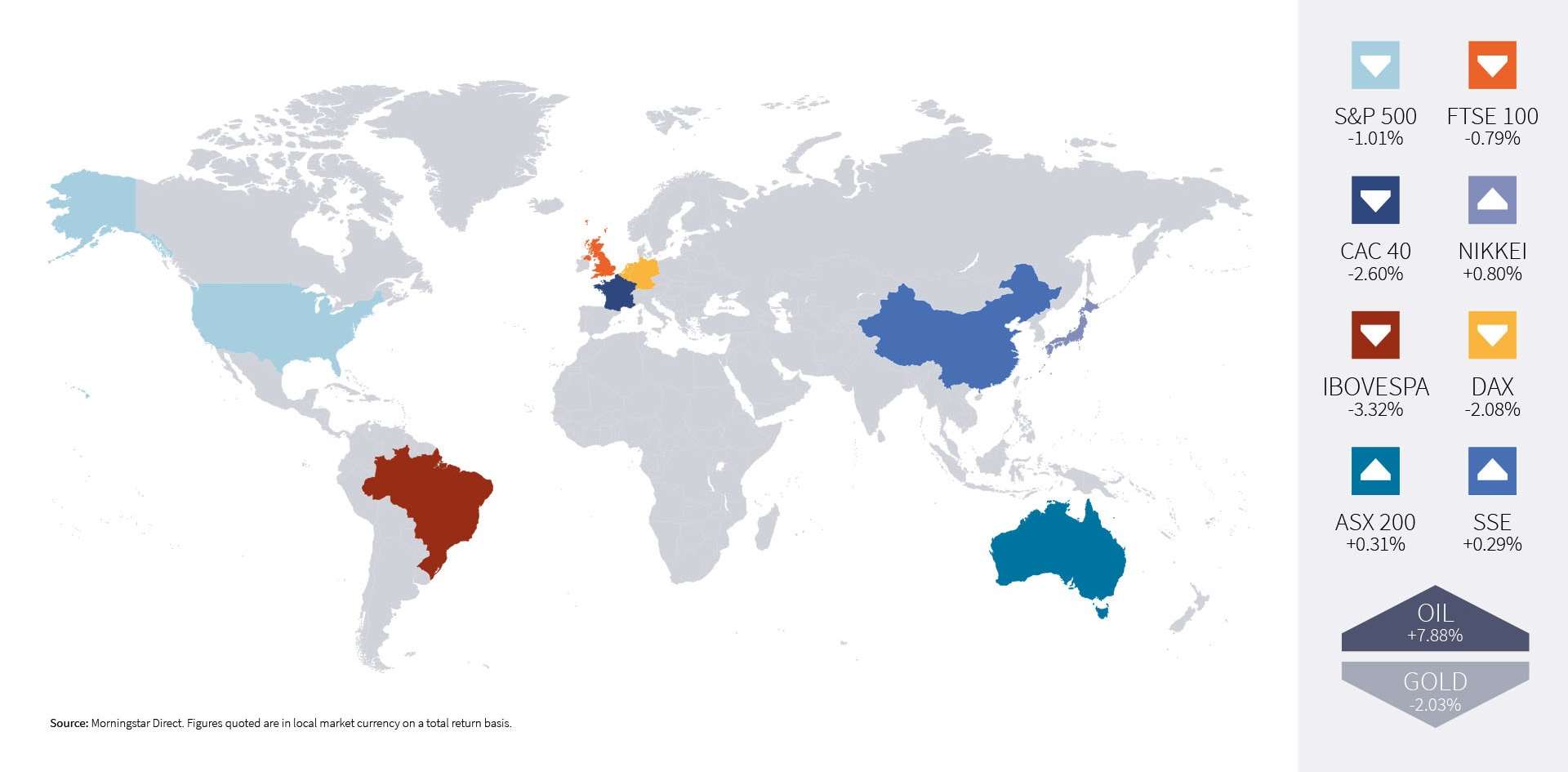

Global Market Returns (January 2021)

HELPLINE:

HELPLINE: