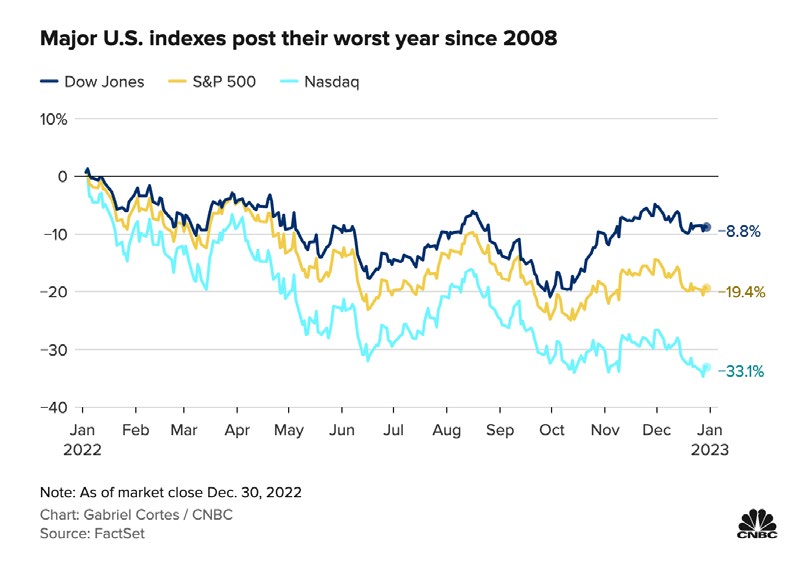

ANNUS HORRIBILIS FOR EQUITIES AND BONDS

Stock markets ended 2022 notching up their worst year since 2008. In the US, the S&P 500 fell almost 20% and the Nasdaq ended a full one-third lower while in Europe most indices registered double-digit declines. The large defensive companies making up the UK

FTSE100 ended the year broadly unchanged but smaller UK company indices were down nearly 20%. Japan’s Nikkei shed 9% for the year and China’s CSI 300 fell 22%. Meanwhile, bonds entered bear market territory for the first time in 70 years.

Major U.S. indexes post their worst year since 2008

Source: Factset

Markets recovered a little ground in the final quarter as initial signs of inflation retreating from four-decade highs raised investor hopes that the US Federal Reserve would take its foot off the pedal and end its aggressive cycle of interest rate hikes in early 2023.

Prices started to recover in October and November before giving up some of the gains in December. For the quarter, the Nasdaq fell 1%, but the S&P500 gained 7.1%, the FTSE 100 8.1% and the Euro Stoxx 15.5%. Asian stock market gains were more muted, with China’s CSI 300 rising 1.8% and the Nikkei 0.6%.

Attention in December turned to concerns about recession in 2023, the ongoing tight US labour market (which could stymie any hopes of an imminent easing of monetary policy in the US in 2023), and ongoing geopolitical uncertainty regarding the war in Ukraine. This saw stock markets resume declines ranging from 1.6% in the UK to an 8.7% sell-off in the Nasdaq.

The one positive that lifted investor spirits during December was the decision by the Chinese government to reverse its Covid-zero policy – a move that is likely to prove positive for the world economy in the medium-to-long term. But it is also expected to bring short term challenges as the world’s second largest economy tackles the sharp rise in Covid infections that will inevitably ensue after three years of stringent Covid restrictions.

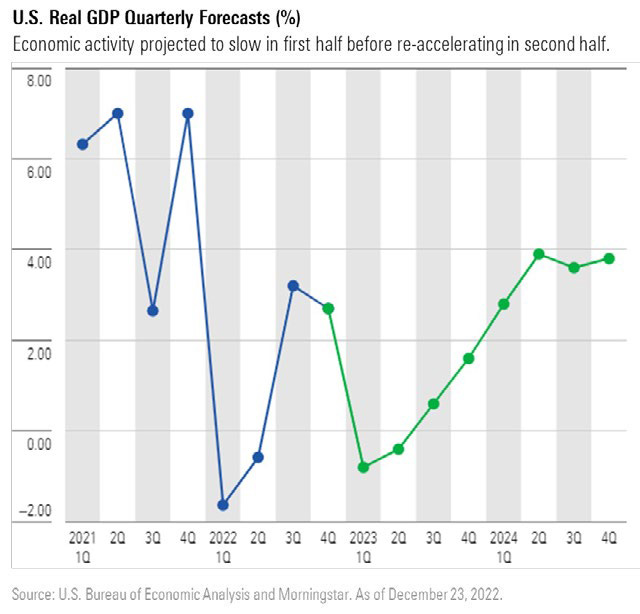

Most commentators expect 2023 to be broadly a year of two halves, with the first half a challenging period as last year’s headwinds continue to prevail. Still-sticky inflation—with core inflation particularly elevated, rising interest rates and a growth slowdown that could well end up in a developed world recession, particularly in Europe—are all forces expected to weigh on markets in the first half of the year.

U.S. real GDP quarterly forecasts

Economic activity projected to slow in the first half before re-accelerating in the second half

Source: U.S. Bureau of Economic Analysis and Morningstar

In the second half of the year, however, the impact of last year’s steep interest rate increases on inflation should become evident. This is seen as paving the way for monetary policy easing. China will again contribute to global growth once it

surmounts its Covid exit challenges and, in a best-case scenario, some sort of peace deal could at last be secured with Russia. In general, there is plenty of optimism that the longer term outlook is good.

New Horizon activity in Q4

In September, international confidence in the UK and the pound plummeted as the new Prime Minister set off on an unconvincing path of seeking to grow the economy out of trouble with tax cuts. The currency and domestic shares fell to extreme levels and as initial signs of central bank support and backtracking emerged, UK equity, property and global equity exposure hedged to GBP was added to the New Horizon strategies.

As UK yields started to retreat from highs, exposure to asset-backed income was also added, with values taking time to fully reflect the retreat in bond yields.

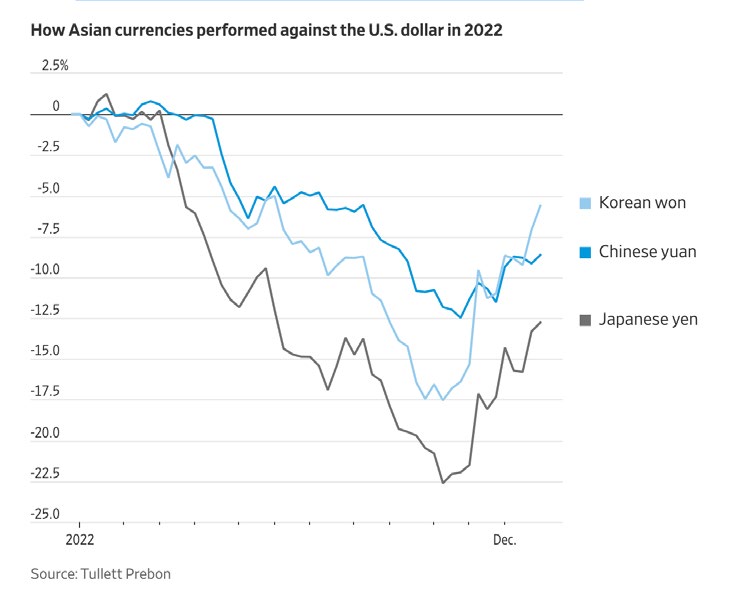

In October, the discrepancy in many Asian currencies and markets also hit extreme levels. While we are confident in the long- term prospects of the Indian economy and Indian equities, the main indices were showing double-digit year-to-date gains and extended valuations.

MSCI India (GBP) three year performance

Source: markets.ft.com

We realised some profit by switching into Chinese equities ahead of the potential relaxing of its zero-Covid policy. Global economists are increasingly optimistic that Chinese economic fortunes will improve during 2023. Goldman Sachs has upgraded its growth forecast for 2023 to 5.2%, J.P. Morgan to 4.3% from 4.0% and Morgan Stanley to 5.4% from 5.0%. Hedge funds have begun closing short positions and buying by domestic investors remains strong.

We also added exposure to Japanese equities and the Japanese yen which had weakened over 30% relative to the US dollar in 2022 and was trading at almost 20% weaker than the previous low points of this century.

How Asian currencies performed against the U.S. dollar in 2022

Source: Tullett Prebon

The multiple, tactical minor switches made in the autumn all proved timely as over the remainder of the year there was moderation in the valuations that had moved to extreme levels both in the UK and Asia. As well as tactical changes within the Fund, strategic switches within the models were recommended in the final quarter. These included a reduction in broad bond exposure by:

- Reducing the position in the iShares Global Aggregate Bond fund to maximise the greater potential for recovery in equity markets from 2023; and

- The inclusion of exposure to the Invesco Nasdaq100 ETF which may rebound quickly if the US Central Bank eases its enthusiasm to raise rates. This was balanced by adding ETF exposure to global equities with strong value characteristics which should perform relatively well in an ongoing higher interest-rate environment.

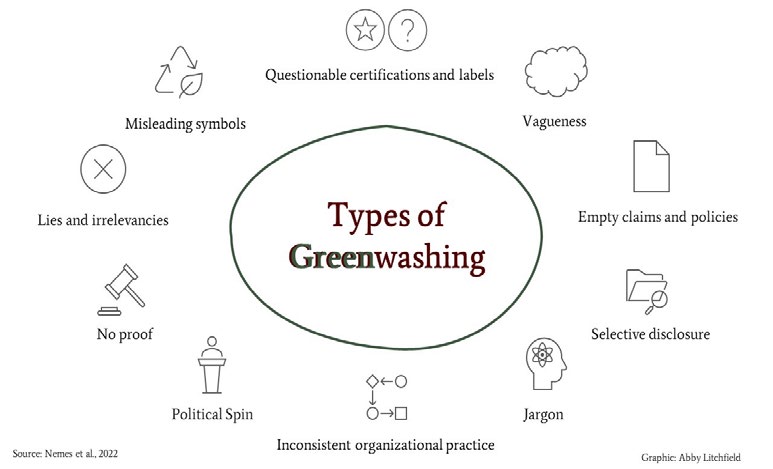

2022 and sustainability

Sustainable investing may have had a tough 2022 but the long-term focus is increasingly going to be on investing responsibly in accordance with environmental, social and governance (ESG) considerations. Some of the challenges that weighed on sustainable investing during the year included limited progress on climate action at the COP 27 conference, greenwashing and a lack of standardisation of key sustainability information. Regulators are increasingly determined to ensure ESG claims do not mislead end investors.

Types of Greenwashing

Source: nbs.net

Restriction in food supplies has seen the immediate emphasis shift towards food security and how to secure a sustainable future for food. In December, the African Union and the US announced they had established a strategic partnership to work towards achieving African food security. Africa has suffered most from the food security fallout of the Ukraine-Russia war.

Meanwhile, Europe took the lead in working towards longer-term food sustainability by targeting food sustainability standards for its key trading partners equivalent to its own and by committing to sustainable agriculture that is kinder to the environment and climate. COP 27 increased awareness that despite food systems accounting for one third of human-made greenhouse gas emissions they command only 3% of climate finance. Investment in companies set to benefit from increased focus on sustainable food systems (accounting for 2% of the New Horizon Fund) was added towards the end of the year.

Review of our 2022 crystal ball

A year ago in our outlook for 2022, we put out a cautionary piece at a time when the bunting was out for an S&P500 index at an all-time high, supported by low interest rates and a bit of post-Covid optimism. There were a few straws in the wind: Bank of England doom-mongering on inflation, military build-up on Ukraine’s borders, over-valued growth stocks etc. but nothing out of the ordinary to trouble seasoned investors. However, an awful lot did happen and all the scenarios turned out to be rather more prescient than expected. Below, we take a look at our comments from this time last year and the outcomes…

1. We said: The Bank of England finds it is unable to raise rates as fast as the Federal Reserve. While it was possible for the Bank of England (BoE) to follow the Federal Reserve and other central banks to a zero-interest rate policy (ZIRP) in 2008, raising them again is not so straightforward. The US mortgage market prices repayments of long-term interest rates so is little impacted by movements in base rates. In the UK, mortgage payments are broadly linked to base rates, so any rise will immediately impact the property-owning middle classes, the main prop to economic recovery. The BoE may find it is almost impossibly conflicted between its mandate of fighting inflation whilst keeping consumption— and the property market—alive and well.

We say: This happened pretty much word for word. The Bank of England fired the starting gun on raising rates but their hawkish rhetoric in November and December 2021 didn’t pass the smell test. The gilt market didn’t fall for it and Governor Andrew Bailey was criticised for poorly communicating with markets. The expression “unreliable boyfriend”, first levelled at Mark Carney by the Treasury Select Committee in 2014, re-surfaced many times in Q1.

2. We said: Crude oil (Brent) price rise is limited to around current levels at $75. If, as is already the case, the Federal Reserve continues to tighten monetary policy, both with the tapering of bond repurchases as well as raising rates faster than elsewhere, then the continued rise in the US dollar will likely limit further rises in dollar-priced crude oil. Furthermore, for any extended period it is economic activity that drives the price of oil, not the other way around. An easing of pent-up demand could stop the rise in the price of crude in its tracks.

We say: Brent started the year at $80 per barrel and ended at $85. However, it hit $120-$130 due to the invasion of Ukraine which, of course, was unknown and not factored into the forecast. However, US dollar strength and markets switching their concerns from inflation to recession undoubtedly led to the collapse of the oil price back to where it started the year.

3. We said: The FTSE100 outperforms the S&P500. This is really about the different composition of each index, the FTSE being relatively heavily weighted with financials etc. Yet it is also about the large growth companies at the top of the S&P which are pushing new valuation highs. A weaker sterling, due to lower interest rates than the US, should be good for the headline FTSE index which comprises proportionally far more international exporters. Around 75% of FTSE100 earnings come from non-sterling income. Other off-putting factors like Brexit may fade in the eyes of foreign investors who may have been absent for some years.

We say: This was alarmingly correct. The FTSE100 rose 1% and the S&P500 fell 20%. pretty much for the reasons stated.

4. We said: Geopolitics will continue to impact markets all year. This includes everything from the situation in Ukraine to the tense state of affairs in the South China Sea and Taiwan. The looming pact between Russia and China could be discomforting for the major powers and other Far East nations – especially Japan – and such concerns have a habit of puncturing stock market enthusiasm. Anything from a rogue missile test to a hardening of resolve over border disputes can impact edgy markets ready to quickly take flight to safety. It needs to be remembered, however, that such concerns have often led to buying opportunities as these situations blow over.

We say: Sadly this couldn’t have been more prescient. Furthermore, while the rogue missile tests and border disputes became a real war, it threw up investment opportunities all year as markets over-reacted, something we have seen many times over the last 25 years.

5. We said: The gold price resumes its rise. The relationship between the price of gold, the US dollar and inflation is more complex than many think. It is far from being the perfect hedge against inflation—some would say none at all in the long term. But that doesn’t mean it won’t be bought for that purpose if headline inflation stays stubbornly high and investors seek a safe haven in volatile markets. Gold may also remain attractive to those wealthy investors with a more jaundiced view of fiat currencies but who are reticent to own cryptocurrencies.

We say: This started well. Gold was up 14% by early March. But the inflationary pressures from the invasion of Ukraine contributed to a greater determination at the Federal Reserve to raise interest rates. The prediction of a “flight to safety in volatile markets” came true but cash became a more attractive safe haven than gold which, as we all know, doesn’t pay interest. Gold finished the year up 1%.

6. We said: Covid is over for financial markets. The chances of Covid and the fear of further variants fading as an issue of public and political concern in 2022 is zero. But will it bug the stock and bond markets? If the performance of the S&P is anything to go by, the markets have moved on, seemingly taking the view that while new variants may be inevitable, as long as they are less deadly, then companies can get back to running their businesses. The legacy of Covid may, however, be felt by companies in other ways. Society may, for example, collectively decide that the previous normal of full-time commuting was anything but normal, productive or sensible. And while conference call software has been available for over a decade, it took the pandemic to get people to use it en masse.

We say: This was a prediction of markets’ view of Covid rather than a medical one and so was correct. There is also an argument for a bonus point on the prediction of a new employment landscape, now evident, particularly in the City of London. Ask anyone who has been around long enough about their worsening commuting experience in the 10 years before Covid and they will probably tell you that, by any objective measure, it was anything but normal.

7. We said: Higher wages impact corporate profits. Take a quick glance at inflation forecasts of 6% or more going into the first quarter and you can see where pay demands are going. It might not stop there if unions and employees get the bit between their teeth in a push for compensation for a decade of zero or sub-real- term pay rises. The extent to which this is already factored into corporate earnings forecasts is hard to say since this hasn’t been a consideration for a long time. There will be plenty of analysts who haven’t tinkered with that part of the spreadsheet in their career.

We say: Unfortunately, this all came true as well. It took a while, but the unions did get the bit between their teeth with even more determination than in the 1970s. The cost-of-living crisis became a global phenomenon and, whilst rising rates didn’t impact US consumers as much as UK and Europe (nor rising gas and gasoline prices), the cracks showed in the Q3 results season as average US wages rose from

$26.74 per hour to $28.10.

8. We said: Extreme volatility in cryptocurrencies. The differing approaches by regulators and tax authorities around the world is an indication that cryptocurrencies and related assets remain poorly understood. There are few safety nets, and risk warnings galore. For some, the cryptocurrency boom resonates with the dot.com boom while, for others, celebrity interest in non-fungible tokens (NFTs) for digital art has helped broaden awareness. It’s new, it’s exciting and, while trends remain positive, there is a palpable sense of missing out for those not already in on it.

We say: FTX was the third-largest cryptocurrency exchange by volume and went bang. Sam Bankman-Fried’s $32bn empire collapsed, taking over a million users with it, and went into Chapter 11 on 11 November. The top two cryptocurrencies, Bitcoin and Ethereum, falling 60% and 67% respectively barely warrants a mention by comparison.

9. We said: Market performance broadens at the expense of tech. Persistently low interest rates, huge distortions caused by the irresistible rise of large tech names like Apple, Amazon and Tesla, and most recently the changes in habits due to Covid, have left value stocks out of favour for many years. But there remain plenty of good and well-managed companies which will almost certainly be in good health 20 years from now. Rising interest rates, combined with an easing of pent-up demand, could prompt many investors to sense that the game has changed.

We say: Sadly, all too true. The charts are too unutterably ghastly to describe, so here are the yearly performance figures for Apple, Amazon and Tesla respectively: -27%, -50% and -65%. Enough said, other than to point out that these three were significant contributors to the disparity in Prediction 3, above.

10. We said: Biden, Johnson and Macron all at risk. For those who still believe in polls, it will be a surprise if the above three all get through the politics of 2022 unscathed. For global markets, the US presidency is the only one of genuine concern. The possibility of a sudden change at the top cannot be dismissed. You can’t position a portfolio for that scenario although it would undeniably lead to market volatility because markets hate uncertainty. But like most political events, markets have a remarkable ability to look through any setback for opportunities.

We say: All true. None of them got through 2022 unscathed but Boris Johnson’s defenestration in early September was the most spectacular, his 80-seat majority from the 2019 election a distant memory. French President Emmanuel Macron suffered a humiliating election in June and became the first president in the Fifth Republic not to win a majority. He was fortunate not to have been forced to dissolve parliament by year end. Joe Biden came through the November mid-term elections better than expected. This probably owed more to the failure of Republicans to put up credible candidates in key states rather than enthusiasm for Democrats and the status quo. US politics is so polarised that this was always going to be a coin toss and so it proved. The prospect of a change at the top, however, remains a distinct possibility.

The themes anticipated, all of which were reflected in different aspects of the New Horizon strategies, each played out to a large degree during the year and contributed to the resilient performance of the New Horizon models. The volatility of gold and oil was certainly greater than expected due to the conflict in Ukraine, but the balance of commodity exposure served the strategies well. We resisted repeated requests to incorporate crypto assets and have shifted equity exposure away from US technology. Overall, not a bad haul in a confusing and unpredictable year.

Ten scenarios for 2023

We now plunge headlong into 2023 and put forward the following scenarios to be reviewed next January with red biro at the ready (in no particular order):

- All the major central banks will reverse policy. The base effect on annual inflation data has already kicked in, much to the relief of markets and central banks. However, attention had already switched in the fourth quarter to the effect higher interest rates were having on developed economies. What concerns investors now is just how much of a slowdown the US economy will suffer and US labour data will be more closely watched than inflation. After all, even if year-on-year inflation comes down, it won’t mean prices are falling. In short, the US Federal Reserve will not be slow to cut interest rates if the economic damage is evident in Q1.

- Crude oil (Brent) is limited to around $75 per barrel. This is a repeat of last year’s prediction which, save for the Russian invasion of Ukraine, would have been far more accurate. What is notable is that the price of oil fell from a peak of $124 to about $84 by year end. This is linked to point 2 above because, over any extended period, it is economic activity that drives the price of oil, not the other way around. Indeed, a dramatic slowing of the US economy could see prices fall to $60 – $50 levels by the summer.

- The S&P500 outperforms the FTSE100. This is a complete reversal of last year’s (correct) forecast based on the composition of both indices, the FTSE being relatively heavily weighted in financials when interest rates looked certain to rise faster than many expected. This year, while there will be severe challenges for Europe and the UK in trying to build inventories for next winter, a fall in the price of oil could impact the FTSE more than the S&P. Notable also was the recovery of

sterling in Q4 as the interest rate hiking cycle fully sank in. Sterling weakness, which supported UK exporters through 2022, is unlikely to give the same support in 2023. - ECB and Christine Lagarde at risk of a major policy error hitting European bonds. European governments have big plans for 2023 with some EUR1.3 trillion of issuance planned. Running parallel to planned ECB quantitative tightening starting in March, that’s a lot of new bonds for bond markets to digest. International investors in particular will need some encouragement to buy new issuance following a year in which most were, if anything, unwinding their bond funds. ECB President, Christine Lagarde, left it late in the year to deliver her most hawkish speech yet which included guidance of more half-point hikes to come. Raising too far too fast will severely test the very bonds European governments are trying to issue and the euro crisis of over a decade ago will not be far from investors’ minds.

- Japanese stock and bond market has a mini-meltdown. Japan has for decades had a habit of being out-of-kilter with the rest of the world. In a year where the main central banks responded to runaway inflation with interest rate hikes and quantitative tightening, the Bank of Japan embarked on a programme of aggressive inaction, keeping rates at -0.1%. While US 10-year yields raced up from 1.75% to 4.25%, Japanese 10-year bonds stayed in cryogenic suspension with various BoJ interventions capping the yield at 0.25%. However, in late December, the cap on yields was lifted to a dizzying 0.5% – which is exactly where the yield raced to and stands today. Even here, this looks untenable by any objective measure and surely must go higher, which will be bad news for both stocks and bonds.

- Putin removed from power and a Ukrainian peace deal. The war has arguably reached an unwinnable stalemate for both sides, but the determination of Ukraine is in complete contrast to the rising opposition to the war in Russia. It is impossible to know how or by what means Putin leaves power but there is a palpable sense of opposition to the war coming from his inner circle. It goes without saying that such an event would have a positive impact on markets globally.

- The UK housing market falls far more than in the US. There are marked differences in the mortgage markets of both countries. In the US, where mortgages are linked to long-term interest rates, last year’s rate hiking cycle had a relatively smaller impact on consumers. The same cannot be said of UK mortgage payers where mortgage payments are linked to base rates. While it is true that far fewer people hold variable rate mortgages than in previous decades, many fixed rate mortgages are terms

of only two years, meaning that there will be a steady trickle of re-mortgaging requirements in a market where many deals have been removed by the banks. A rise in the number of buy-to-let landlords throwing in the towel could hit London especially hard in 2023. - Emerging markets stage a big recovery. Last year was almost a perfect storm for emerging markets. A combination of a strong dollar, rising interest rates and the Covid lockdown policy in China was about as bad a combination for emerging markets as could have been imagined. The likelihood of the Federal Reserve curtailing its hiking policy has already seen the US dollar weaken since November. The lifting of Covid restrictions has obviously caused major problems for Chinese healthcare infrastructure, but the re-opening of trading routes throughout the region, as well as a lift to Chinese demand, could have an immediate beneficial impact for emerging markets.

- Gold to recapture last year’s high of $2,050. Gold is not the hedge against inflation that many believe, as witnessed last year when gold fell throughout the summer before recovering to a modest gain for the year. The rising costs of borrowing dollars to fund gold, which of course doesn’t pay interest, is likely to settle or even reverse in 2023. Gold may also be relatively more attractive than cryptocurrencies for those looking to diversify away from volatile currencies. A slowdown in the US economy is also clearly in the minds of those looking for a safe-haven asset. China has started large purchases of gold for the first time in three years.

- China allows the yuan to fall significantly relative to the US dollar. A combination of demographics, the failure to move to a consumption-based economy and a fragile property market may prompt the Chinese authorities to give exports a shot in the arm by allowing a much weaker yuan. Japan mulled a similar strategy to boost exports, profits and wages for two decades but never had the gumption to do it. China, on the other hand, seems to revel in announcing shock changes in policy which, in hindsight, appear perfectly rational for their national interest.

GLOBAL MARKET RETURNS Q4 2022

HELPLINE:

HELPLINE: