Principle & Objectives:

Having become the preferred investment for French people, who devote the majority of their financial savings to it, assurance vie is a vehicle for both savings and protection. Thanks to a special legal regime, assurance vie savings allow you to:

• Build up savings at your own pace, flexible and available: you can make payments and withdrawals at any time (to make another investment, prepare for retirement, etc.),

• Lighten your tax burden, • Protect your loved ones by facilitating the transmission of your assets and benefiting from unique inheritance tax exemptions,

• Allows to constitute a guarantee during a bank loan and can thus constitute, according to your situation, a vector of fiscal and financial optimization.

Contribute to your assurance vie policy:

Once you have chosen your assurance vie policy, you are free to invest in it according to the terms and conditions you choose.

• You can pay the sums of your choice, when you wish, by cheque or bank transfer. • Through scheduled payments, the sums invested in the contract are automatically withdrawn from your current account and according to the periodicity you have chosen: monthly, quarterly, annually

• You have no constraints as to frequency or amount and your contract remains accessible throughout your life.

Dispose of your savings:

AVAILABILITY OF SAVINGS:

• Your savings are never blocked. You can withdraw (buy back) all or part of the sums invested at any time, free of charge: either by a simple buy back request, or by setting up scheduled buy-backs, the frequency of which you choose, the sums withdrawn are then paid into your current account. Article L132-21 of the Insurance Code stipulates that in the event of a surrender request by the policyholder, the insurance or capitalisation company will pay the surrender value of the policy within a period not exceeding two months.

• Some contracts also offer you the possibility of a life annuity: your capital is thus converted into an annuity that will be paid to you throughout your life and that of the beneficiaries you have chosen.

TAXATION IN THE ABSENCE OF REDEMPTION:

The capital gains generated within the contract are not subject to taxation, only the interest on the fonds euro(s) is subject to social charges (17.2%) each year.

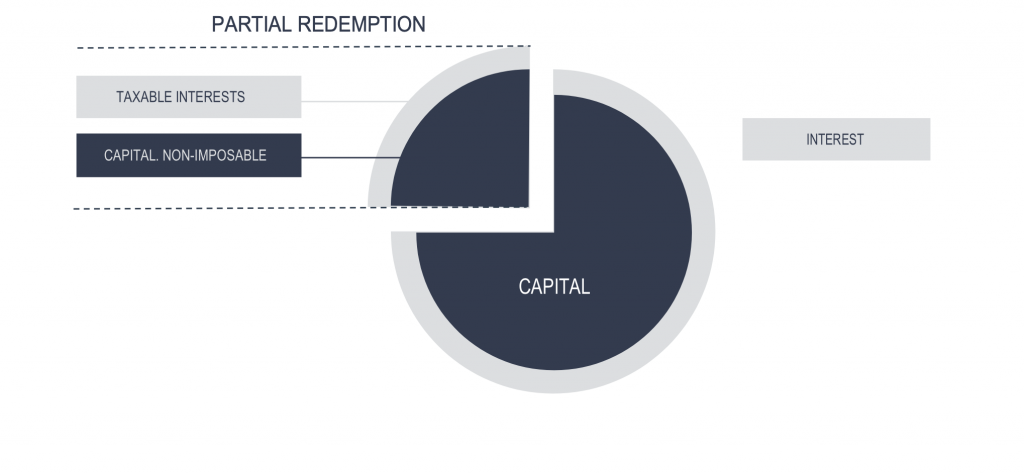

TAXATION OF A PARTIAL OR TOTAL WITHDRAWAL:

In the case of a partial or total surrender of your policy, only the interest (profits) held within the surrendered part will be subject to taxation.

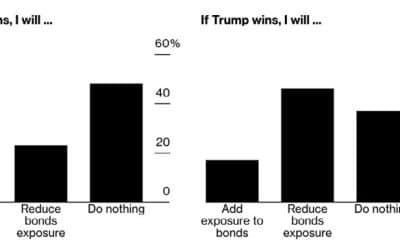

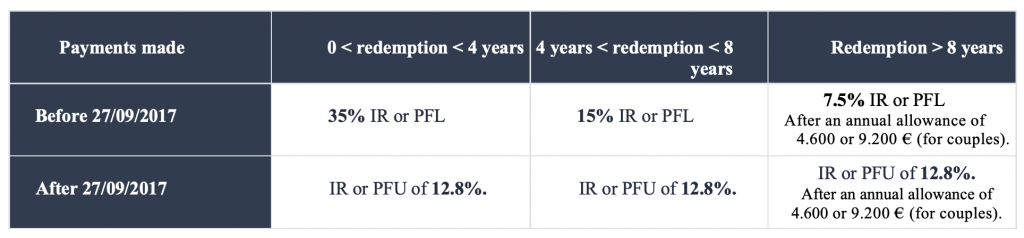

Concerning the taxation of capital gains, you have the choice between being subject to income tax or to a flat rate withholding tax that varies according to the length of time the contract has been in force:

IR: Income Tax (Marginal Tax Portion)

PFL: Prélèvement Forfaitaire Libératoire (flat-rate withholding tax)

PFL: Prélèvement Forfaitaire Libératoire (flat-rate withholding tax)

PFU: Prélèvement Forfaitaire Unique (Flat Tax) is a one-off levy of 30% on income from savings and capital excluding real estate, including income tax at the rate of 12.8% and Social charges of 17.2%.

The Social Deductions (17.2%) are levied on a run-of-river basis, whereas on the Units of Account the taxation of the Social Deductions will only take place when the subscriber proceeds to a partial or total redemption and will concern the share of interest included in the redemption at the rate in force.

Note:

• For contracts taken out before 1 January 1983 and 26 September 1997, special rules apply. In this case, these contracts should be audited with the help of your consulting firm.

• In certain cases, the redemption may be tax-exempt: dismissal, judicial liquidation or early retirement of the subscriber or his or her spouse (applies until the end of the year following the year in which the event occurs).

Termination of the contract due to death:

• On the day of your death, the Insurer undertakes to pay the sums invested to the beneficiary that you have determined in the contract. This beneficiary clause is essential because it is the beneficiaries indicated in this clause who will be in charge of collecting the capital remaining in your contract on the day of your death. It is from the existence of this clause that assurance vie derives its vocation as a tool for the transmission of your assets.

• Beneficiaries must be mentioned in your contract at the time of subscription and you can decide to change them at any time. • Very often, due to lack of knowledge or advice, the insured policyholder opts for the so-called “standard” clause, i.e.: “my spouse, or failing that, my children, or failing that, my heirs”. In many cases, for personal, legal and/or tax reasons, this clause is not very or not very appropriate and may lead to an incoherence in the patrimony or an over-taxation on the day of the death (particularly in the case of contracts subscribed in community). It is therefore important that you pay full attention to this clause and that you consider, with the help of your advisor, all possible situations.

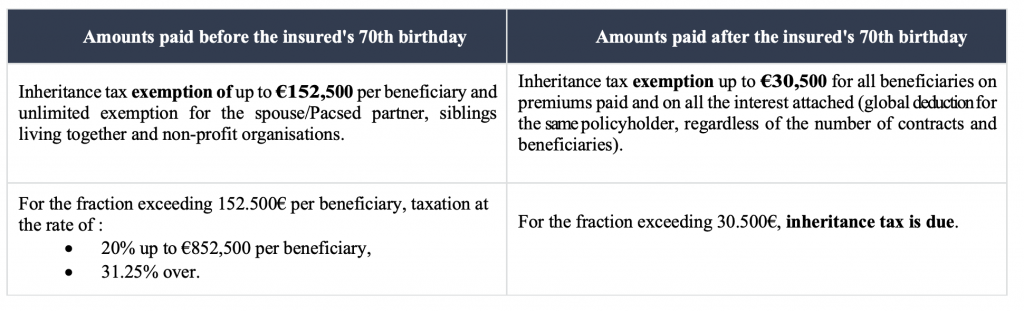

Although it is common to say that assurance vie is not an inheritance, the tax treatment of the capital remaining in the contract will depend on several factors, in particular the date of subscription of the contract, the amount of the sums transferred and the age at which the payments were made:

Investment vehicles:

In addition to its advantageous tax treatment, assurance vie policies offer a wide choice of investment vehicles to meet the needs of both the most secure and the most daring savers. A majority of fonds euros for more security, more bond, equity or real estate vehicles to boost your savings Depending on your asset situation, your return objectives, your investment horizon (short, medium or long term), your investment preferences and aversions, it is possible to determine, develop, monitor and adapt the asset allocation that suits you.

THE FONDS EUROS:

• This is the safest part of your investment: the part of your capital paid into the fonds

euros is here managed and guaranteed directly by the insurance company.

• The interest you receive is definitively yours, is covered by the same guarantee as the capital you initially subscribed to and will itself be interest-bearing: this is the ratchet effect of the fonds euros.

MUTUAL FUNDS (Unités de compte) :

• A unit of account is a financial investment vehicle such as units or shares in transferable or real estate securities (SICAVs, shares, bonds, mutual fund units, SCI units, SCPI units). There are hundreds of units of account of great diversity.

• It is up to the investor (with the help of his or her advisor) to select those that best suit his or her profile and risk sensitivity.

• Indeed, the capital is not guaranteed, only the number of units of account is. In the event of unfavorable economic conditions, it is possible to recover a lower amount of savings than that initially invested (unless specific protection clauses are included). On the other hand, unit-linked products offer the prospect of high returns if the financial markets perform well.

HELPLINE:

HELPLINE: