PART 1 : PENSION PLANNING ONCE ONE IS FRENCH TAX RESIDENT

When moving to a foreign country, one of the things one must consider is “pension planning”.

In France, for years retirees relied solely on the state pension system called “systéme de retraite par reversion”, a reversionary pension system.

It is only in the past 20 years, due to excess in the number of retirees with the baby boomers reaching pension age, that personal pension schemes, such as the Plan d’Epargne Retraite Populaire (PERP) which is similar to a UK Personal Pension Plan, or the “Loi Madelin Plan Retraite” for self-employed, and the “Article 83” occupational plans have slowly developed. These policies may not be of interest to all expatriates. But for those that live and work in France as self-employed with Auto Entrepreneurs, Enterprise individuelle statuses or who own Limited companies (SARL, SAS..) we strongly advise them to read our “Loi Madelin” policy section, as these policies not only may be an exciting pension planning vehicle, but also help individuals or companies reduce their tax expenses.

As far as overseas pension planning is concerned HMRC’s 5th of April 2006 pension reform act has been a turning point, enabling British expatriates as well as foreign nationals having worked in Britain for a period, to transfer their personal and private UK pensions overseas free of tax, by using the Qualifying Recognised Overseas Pension Schemes (QROPS).

These overseas schemes have many advantages such as flexibility, accessibility and are multi-currency.

For the French Tax resident, transferring a pension to a QROPS can become doubly beneficial.

For instance, since April 2015’s « Freedom and choice in pensions” act, individuals can « Flexi access» 100% of their UK pension fund after the age of 55, enabling them to withdraw their entire pension pot at once.

For French tax residents, in particular, this set up is an opportunity to upgrade their pension planning to a more advantageous solution, offering tax advantages on withdrawals, overriding France’s succession law’s and providing additional inheritance tax allowances to their heirs, and more.

As an example:

1. If one has moved to France after the age of 55 and planned to withdraw a lump sum from their UK Personal Pension Scheme regularly. They would be entitled to paying up to 45% French income tax as well as social tax (unless they are still paying into their UK social contributions, in which case they are exempt of such charges in France) , on that entire amount. Please note that the new “prélèvement à la source” PAS system which took place on 1st of January 2019 in France, has no incidence on the existing “marginal tax scales” TMI. On top of this, Social Tax is also due, as well as facing unpredictable currency changes (and that is without considering Brexit influence).

2. If on the other hand, once moves their pension Scheme to a regulated QROPS, thus avoiding a 55% tax penalty which one would face, if their pension was transferred to anything but a QROPS, and then as from the age of 55 onwards they chose to “Flexi access” their entire QROPS pension pot. In return of a small 7,5% tax (article 163 bis, II du CGI), and (if one has stopped paying social charges in the UK), an additional 9,1% social tax charge, one could reinvest their entire pot into an extremely flexible investment wrapper. Offering as many options as tax benefits and enabling them to reduce their tax bill on the same complementary pension income as before, up to 60%, and consequently save themselves and their heirs a considerable amount of money.

If this is set up and orchestrated by proper wealth management engineers, in respect of EEA regulations, and if all the necessary ingredients are in the equation, this strategy is a powerful expat estate planning tool.

DTB Wealth Management’s experts are regulated and have the know how to help set this up and help meet one’s objectives.

PART 2: WHATEVER THE CASE MAY BE, WHAT OVERALL CONSEQUENCES WOULD BREXIT HAVE ON EXPATS AND FOREIGNERS PENSIONS ?

UK state pension benefits are set by the UK Government.

Generally speaking, if you’ve always lived and worked in the UK, your state pension shouldn’t be directly affected as a result of Brexit.

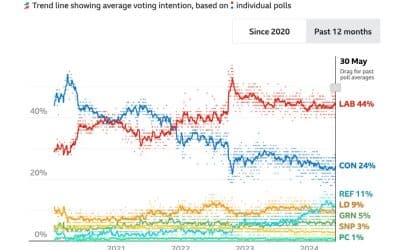

If you’ve moved or move to the EU, Brexit may impact both how you claim your state pension in future and whether it’s increased automatically each year. If the UK leaves the EU under a deal, the UK government will continue increasing state pensions and social security ‘coordination’ will continue between the UK and the EU for citizens who have moved before the end of the transition period. This means that:

1. Periods when you’ve lived in a country or contributed towards the state pension there for more than a year can count towards your pension, even where you’d normally have to live there or contribute for longer than that to qualify for a state pension in that country.

2. The second benefit is that states will work together to pay benefits earned in different counties, which means that you normally only need to make one claim. If there’s a ‘no deal’ Brexit, the UK Government intends to continue to increase UK state pensions paid to UK pensioners living in the EU but will only do so if the EU does likewise for EU pensioners living in the UK. Similarly, the UK Government hopes to continue with social security ‘coordination’ but will only be able to if the EU agrees. Unrelated to Brexit, the state pension age for both men and women is increasing to 66 between 2018 and 2020 and to 67 between 2026 and 2028.

If the UK leaves with a deal, social security ‘co-ordination’ will continue to benefit people who have already moved to the UK from the EU or who move there before 31 December 2020. There are two parts to this.

1. Periods when you’ve lived in a country or contributed towards the state pension there for more than a year can count towards your pension, even where you’d normally have to live there or contribute for longer than that to qualify for a state pension in that country.

2. The second benefit is that states will work together to pay benefits earned in different counties, which means that you normally only need to make one claim. In a ‘no deal’ Brexit, it’s not clear whether this ‘coordination’ will go ahead.

It’s not known whether EU countries will continue to increase the pensions they pay to their citizens living in the UK. Not as a direct result of Brexit. The minimum age at which you can take a pension is set by the UK Government. Tax relief is set by the UK Government and there’s been no suggestion that the UK Government will change this as a direct result of our leaving the EU. But granting tax relief when pension contributions are paid means the Chancellor collects less income tax now. Pension tax relief could be reviewed depending on the UK’s economic performance in future.

If the UK leaves with a deal, along the lines of what is currently proposed, UK nationals currently employed in the EU will keep their existing rights to be employed on the same terms as EU nationals. This will include rights to pension provision. It’s not clear what will happen if the UK leaves the EU as a result of a ‘no deal’ Brexit. EU citizens already working in the UK will be entitled to remain in the UK if they apply for ‘settled status’, which is a new procedure to allow individuals to be recognised as having the right to live and work in the UK. This is the case whether a deal goes ahead or not, though the settled status rules will be different depending on the outcome. EU citizens living in the UK will be able to carry on contributing to personal pensions here.

HELPLINE:

HELPLINE: