If you want to benefit from the most cost-effective, high-level interest rate possible in France, then you need to invest in “La Girardin Industriel”, says financial expert Daniel Butcher…

According to DTB Wealth Management – a “Conseil en Gestion de Patrimoine” (CGP), which solves financial, tax and legal issues for British expats living in France – the “Girardin Industriel” provides the best tax reduction scheme in France.

“Expats can reduce their income tax through the “Girardin Industriel”, which is designed to support farming communities in DOM-TOM countries, such as Martinique and French Guiana,” said Daniel Butcher, founder of DTB Wealth Management. “Because the French government gives a one-off 17-25% discount, on a tax bill of up to €40,900, investors can receive a tax discount of up to 25%.”

Daniel explains that the scheme was designed to encourage private investment in French PME and TPE companies, which are known as SMEs in the UK: small and medium-sized enterprises.

“These islands desperately need materials to work their crops, build infrastructure and to survive in such remote areas,” he said. “The money is used to purchase items such as tractors and rotators.”

However, choosing the wrong company to invest in can cause problems. “The risk here is that instead of buying industrial equipment, the PME or TPE uses the subsidy to buy other materials, such as computers or cars, and so on,” said Daniel.

For this reason it is essential that investors seek the advice of financial advisers with expertise in the “Girardin Industriel”.

“We comprehensively monitor the market and carefully decide who is best to work with,” said Daniel.

The tax advantage is paid directly by bank transfer into the investor’s bank account. Those who invest in December will recuperate their money seven months later in September.

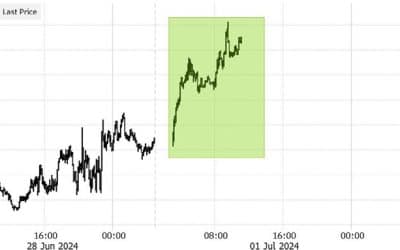

The interest rate starts at 25% in January and reduces down by 1% each month throughout the year.

“For example, if the if the client opens the policy in June he will only get a 19% discount on his income tax the following year, whereas if he opens it in January he will get the full discount of 25%,” said Daniel.

“The scheme is not for everyone, as you would have to be paying at least €8,000 to €10,000 income tax on household income to want to invest,” said Daniel. “But for clients who are interested, we would be delighted to share our knowledge and help them to achieve the most lucrative and stress-free investment possible.”

HELPLINE:

HELPLINE: