“Leaseback introduced in France in the last century, mainly in sought of locations such a Paris, Côte d’Azur and the Alps is very similar to LMNP only it also enables the buyer to personally use the property” As long as you carefully select the developers and management companies, Leaseback is unconditionally an exciting combination between investment and holiday home”.

What is a leaseback property?

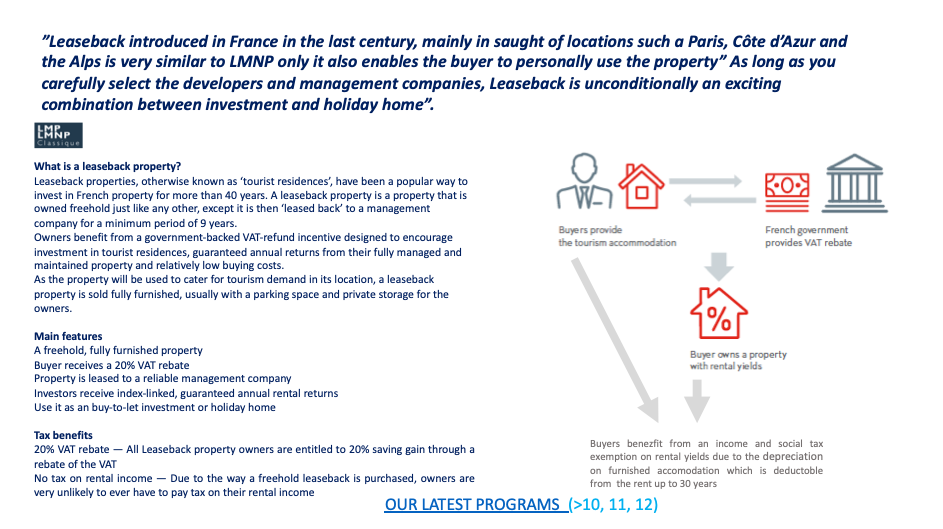

Leaseback properties, otherwise known as ‘tourist residences’, have been a popular way to Invest in French property for more than 40 years. A leaseback property is a property that is owned freehold just like any other, except it is then ‘leased back to a management company for a minimum period of 9 years.

Owners benefit from a government-backed VAT-refund incentive designed to encourage nvestment in tourist residences, guaranteed annual returns from their fully managed and naintained property and relatively low buying costs.

As the property will be used to cater for tourism demand in its location, a leaseback property is sold fully furnished, usually with a parking space and private storage for the owners.

Main features

- A freehold, fully furnished property Buyer receives a 20% VAT rebate

- Property is leased to a reliable management company

- Investors receive index-linked, guaranteed annual rental returns

- Use it as an buy-to-let investment or holiday home

Tax benefits

- 20% VAT rebate – All Leaseback property owners are entitled to 20% saving gain through a rebate of the VAT

- No tax on rental income – Due to the way a freehold leaseback is purchased, owners are very unlikely to ever have to pay tax on their rental income

HELPLINE:

HELPLINE: