EQUITY MARKETS & PRECIOUS METALS RALLY AS INTEREST RATES EASE AND TARIFF WORRIES FADE

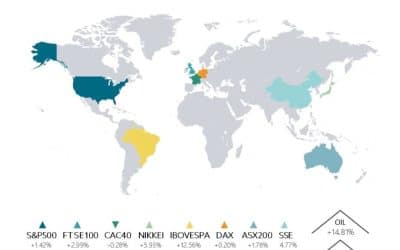

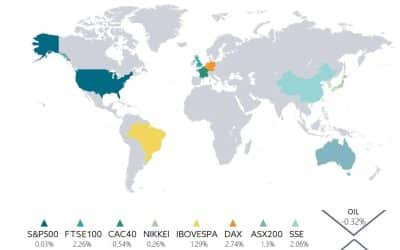

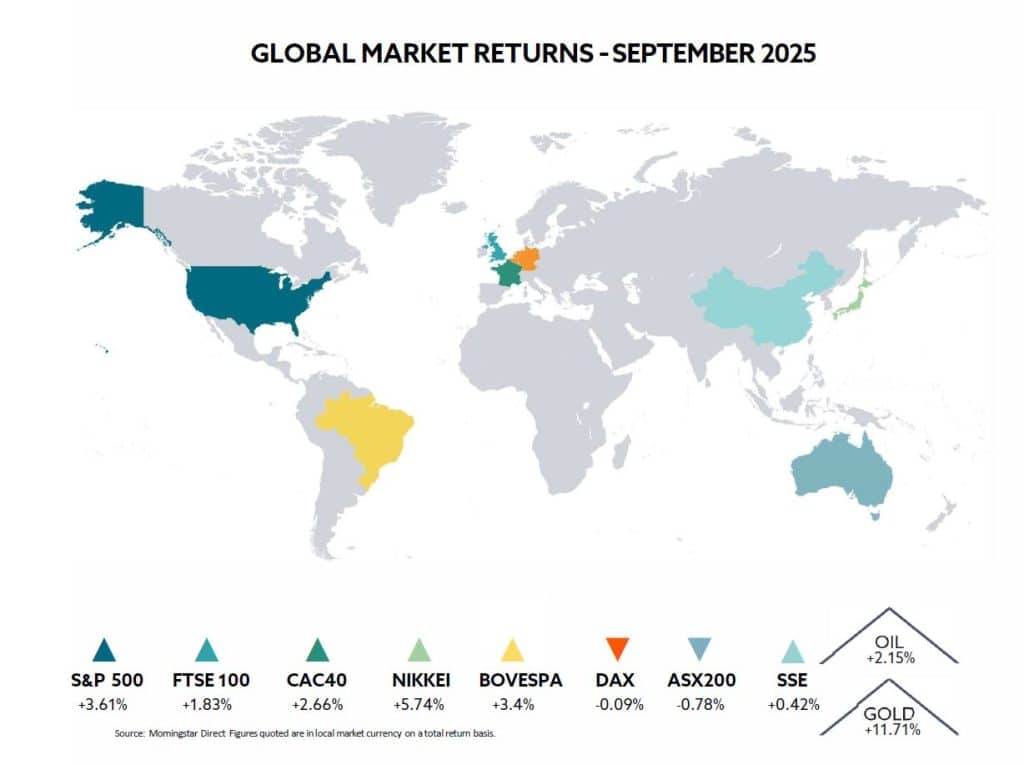

Global equity markets made consistent progress through Q3, reflecting confidence in strong corporate fundamentals, some relief around the impact of tariffs, and encouragement from the increasing signs of monetary easing. The period saw a significant change in Federal Reserve policy and increased market participation beyond the large-cap technology stocks that had led in Q2. However, an element of caution appeared towards the end of the period ahead of a potential government shutdown and concerns that stock markets may have run ahead of themselves.

US equities continued their positive trajectory, with the S&P 500 advancing 8% in the third quarter. A particularly encouraging development was the Russell 2000 Index reaching its first all-time high since 2021, signalling that the rally is broadening to smaller-cap stocks positioned to benefit from lower borrowing costs.

CREDIT SPREADS COMPRESSED TO THEIR TIGHTEST LEVELS IN DECADES

The FTSE 100 index was up over 7% for the quarter, supported by energy and defensive sectors, and is now ahead nearly 18% year to date. The Euro Stoxx 50 index rose 4% during the third quarter, driven by falling inflation and expectations of ECB rate cuts later in 2025. Meanwhile,China’s SSE Composite Index gained almost13% during the quarter.The Nikkei rose more than 11% in the quarter and is 15% higher year to date.

Commodities continue to present a mixed picture. Gold is a standout performer, surging to record highs above $3,800 an ounce driven by safe-haven demand tied to geopolitical concerns, US government shutdown worries, and expectations for continued Fed easing. Silver prices have also rallied impressively, exceeding $45 an ounce. In contrast, energy markets remain subdued, with Brent crude trading in the mid-$60s per barrel range. The broad Bloomberg Commodity Index posted modest positive returns for September and the quarter.

CRYPTO MARKETS REFLECT A TUG-OF-WAR BETWEEN IMPROVING ETF FLOWS AND MACRO RISK SENTIMENT

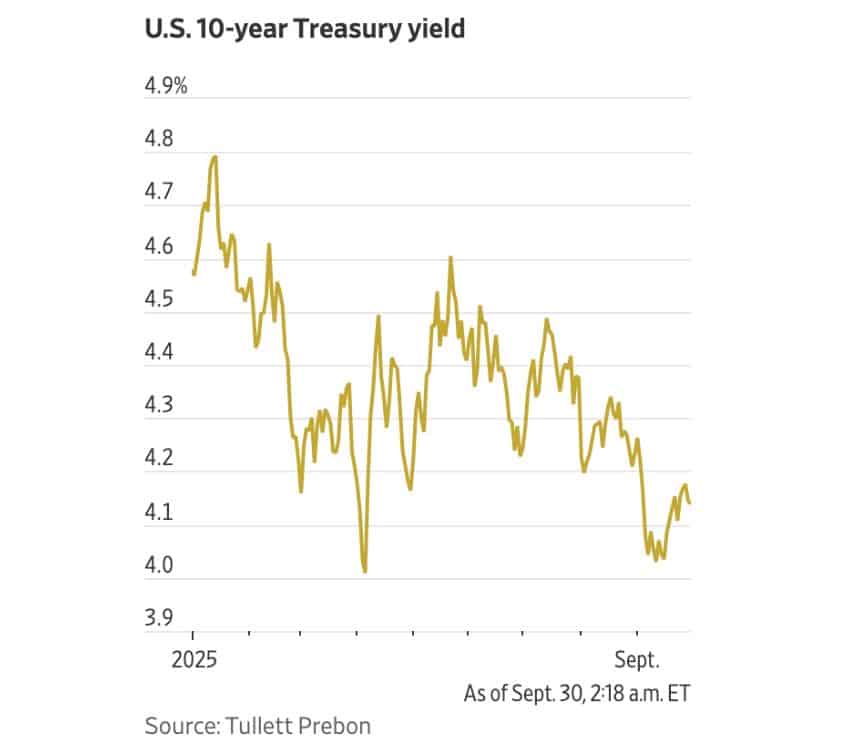

The Fed delivered a 25-basis point rate cut at its September meeting, bringing the federal funds target range to 4.00%-4.25%. Indications from the committee suggest there may be additional easing later in 2025. This caused the US 10-year Treasury yield to decline, settling around 4.20% by late September. The lower-rate environment supported both risk assets and safe-haven flows, while corporate bonds rallied substantially, with credit spreads compressing to their tightest levels in decades.

Bitcoin recovered after mid-September weakness, trading in the $110,000-$115,000 range by month-end. The cryptocurrency market is reflecting a tug-of-war between improving ETF flows and macro risk sentiment.

FAR-REACHING BENEFICIARIES AND EFFECTS OF THE ONE BIG BEAUTIFUL BILL

The One Big Beautiful Bill Act, signed into law in July 2025 represents the most significant shift in corporate tax policy since the 2017 Tax Cuts and Jobs Act. Many commentators believe a prime motivation is the Trump administration’s aim to safeguard the US’s position at the forefront of AI technology. While maintaining the 21% corporate rate, the legislation introduces powerful investment incentives that are likely to reshape capital allocation decisions across American businesses, with technology companies the primary beneficiaries.

MAJOR HYPERSCALERS COULD REALISE COMBINED TAX SAVINGS OF MORE THAN $55 BILLION IN 2025 ALONE

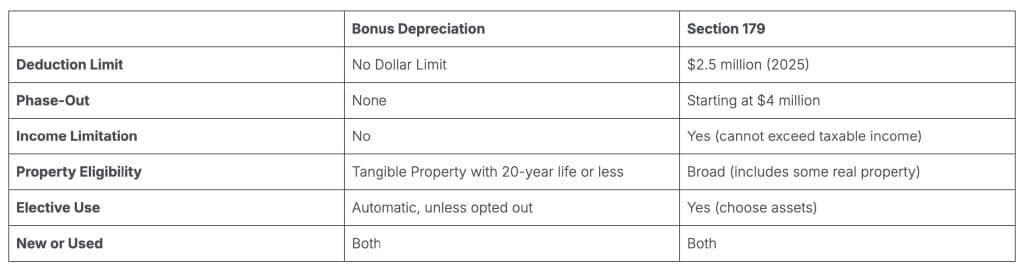

Tech giants engaged in aggressive AI infrastructure buildouts will experience substantial relief through two critical provisions. The permanent restoration of 100% bonus depreciation allows immediate expensing of data centres, servers, networking equipment, and other tangible property. Meanwhile, the restoration of domestic R&D expensing reverses the 2022-2024 cash tax drag that particularly weighed on software, semiconductor, and AI-focused firms.

The financial impact is expected to be material. Analysts estimate that major hyperscalers Alphabet, Amazon, Meta, and Microsoft could realise combined tax savings of more than $55 billion in 2025 alone from their planned capital expenditures of $305 billion. These savings directly improve after-tax returns on the massive investments required to build AI computing capacity, effectively lowering the cost of capital for technology infrastructure expansion.

However, the legislation’s likely impact extends well beyond Big Tech through enhanced expensing provisions. The increased deduction cap of $2.5 million and phase-out threshold of $4 million, specifically introduced for small and mid-market businesses, enables immediate expensing of equipment purchases that previously required multi-year depreciation schedules.

LONGER-TERM CHALLENGES AND IMPLEMENTATION COMPLEXITIES REMAIN

This matters particularly for capital-intensive sectors, including manufacturing, construction, transportation, healthcare, and retail. A regional manufacturer investing in automation equipment or a logistics company upgrading its fleet can now expense qualifying assets immediately, significantly improving cash flow and reducing financing needs.

While the legislation addresses immediate investment economics, longer-term challenges and implementation complexities remain. The reduced tax revenues arising from these provisions, combined with international tax policy shifts (including the US’s withdrawal from the OECD Pillar Two framework), will introduce fiscal and geopolitical uncertainties that could influence future policy sustainability.

UK REGULATOR RELAXES CRYPTO RESTRICTIONS

The UK Financial Conduct Authority’s decision to lift its ban on retail buying of crypto exchange-traded notes, effective 8 October 2025, signifies a notable policy reversal. After restricting access in 2021 due to investor protection concerns, the regulator will now allow retail investors to buy Bitcoin and Ethereum-linked ETNs through FCA-approved exchanges, including the London Stock Exchange. This change reflects the regulator’s stated aim to rebalance its approach to risk while recognising that investors “could lose all their money.”

The UK’s approach positions it between the US’s relatively relaxed stance and the European Union’s more restrictive framework. The SEC has approved multiple Bitcoin ETFs, paving the way for easy retail access to crypto exposure. Meanwhile, the EU’s Markets in Crypto-Assets Regulation takes a more cautious approach, prioritising investor protection and market integrity over accessibility. Switzerland and Germany have been more proactive than other countries in the region, offering retail investors broader access to crypto-related products within their financial systems.

SWITZERLAND AND GERMANY OFFER BROADER RETAIL ACCESS TO CRYPTO PRODUCTS

The UK’s middle path, which permits access but imposes stringent safeguards through Restricted Mass Market Investment classification, suggests policymakers are attempting to balance competitiveness concerns with consumer protection. Notably, these products are not subject to the Financial Services Compensation Scheme and lack UCITS regulation protections.

Wisdom Tree survey data indicates strong demand for crypto investing, with 40% of UK retail investors showing a greater willingness to invest in crypto through traditional financial channels. However, providers acknowledge that these investment vehicles are most suitable for investors that have a reasonably high risk tolerance and can assess specific potential structural issues including tracking and cost drag.

HELPLINE:

HELPLINE: