MARKET OPTIMISM DRIVES RECORD HIGHS

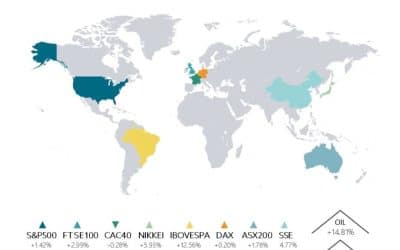

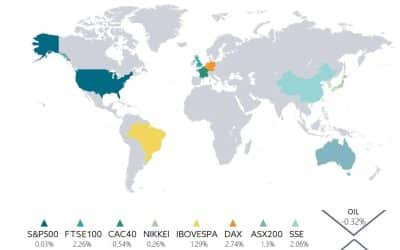

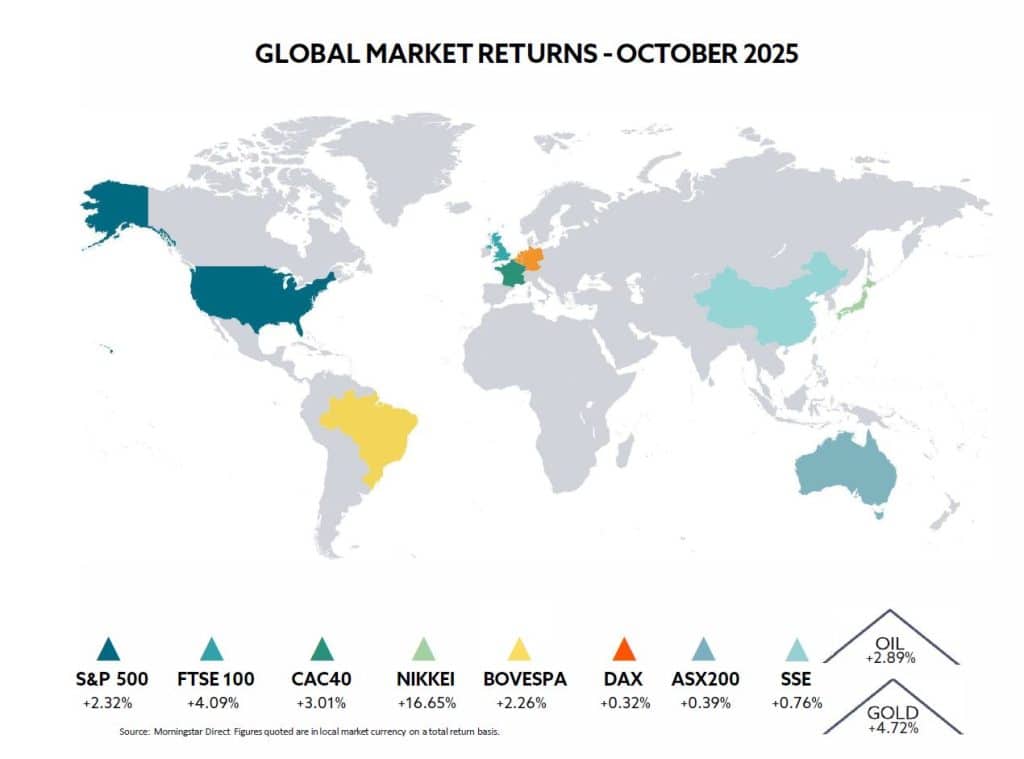

Most equity markets made further progress through October with record highs set. Improved relations between the US and China along with favourable economic data outweighed fears over an AI bubble and concerns around private credit. Precious metals prices hit new highs and bond prices also rallied.

US equity markets surged as September consumer inflation data came in softer than anticipated at 3.0%, supporting investor optimism that the Federal Reserve will maintain its rate-cutting trajectory. The advance was led by technology and financials, with AI-related stocks delivering impressive gains. By late October, nearly a third of S&P 500 companies had reported third-quarter results, revealing earnings growth of 15.1%, almost double the forecasted 7.9%. Revenues were up 7.8%,outperforming expectations of 6.1%. This combination of moderating inflation and robust corporate profitability reinforced bullish sentiment and drove the market’s upward momentum. This all came despite the surprise tariff announcements by President Trump in early October which caused a temporary market reversal, showing the market’s sensitivity to trade policy news.

THIS COMBINATION OF MODERATING INFLATION AND ROBUST CORPORATE PROFITABILITY REINFORCED BULLISH SENTIMENT

The UK’s FTSE 100 managed to deliver 4.1% notwithstanding investor concerns about the upcoming Autumn Budget, persistent inflation, and high government borrowing. Meanwhile, the Euro Stoxx 50 added 2.8% as the European Central Bank again kept rates unchanged with inflation close to target. Japanese stocks exceeded expectations, with the Nikkei 225 posting a sharp gain of 13.3% driven by a new leadership choice in the ruling party and a weaker yen. However, some caution persisted regarding inflation and the domestic growth outlook.

China’s markets were more mixed. On one hand,Chinese technology and AI-related stocks rose strongly; on the other hand, the broader economy, especially the manufacturing sector, continued to show signs of weakness. Trade tensions between the US and China, which had been on the agenda again, also weighed on sentiment but seemed to be resolved by month’s end.

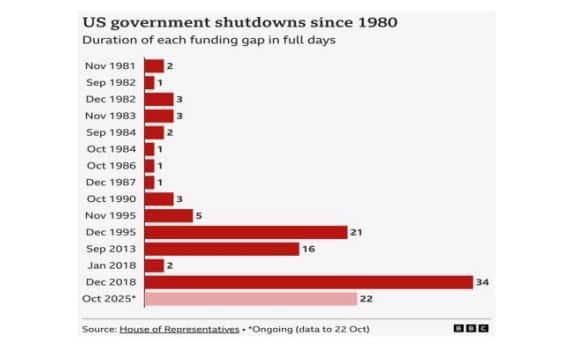

Bond markets posted one of their best performances in recent memory. The 10-year US Treasury yield fell below the psychologically key 4% mark, reaching about 3.98% mid-month—its lowest for the year. This drop in yield was driven by several factors: waning inflation worries, stronger expectations of Federal Reserve rate cuts, safe-haven buying amid geopolitical uncertainties, and delays in key economic data due to a government shutdown. Markets priced in an expectation that the US central bank will continue to focus on its employment mandate with the labour market showing signs of softness.

MARKETS PRICED IN AN EXPECTATION THAT THE US CENTRAL BANK WILL CONTINUE TO FOCUS ON ITS EMPLOYMENT MANDATE

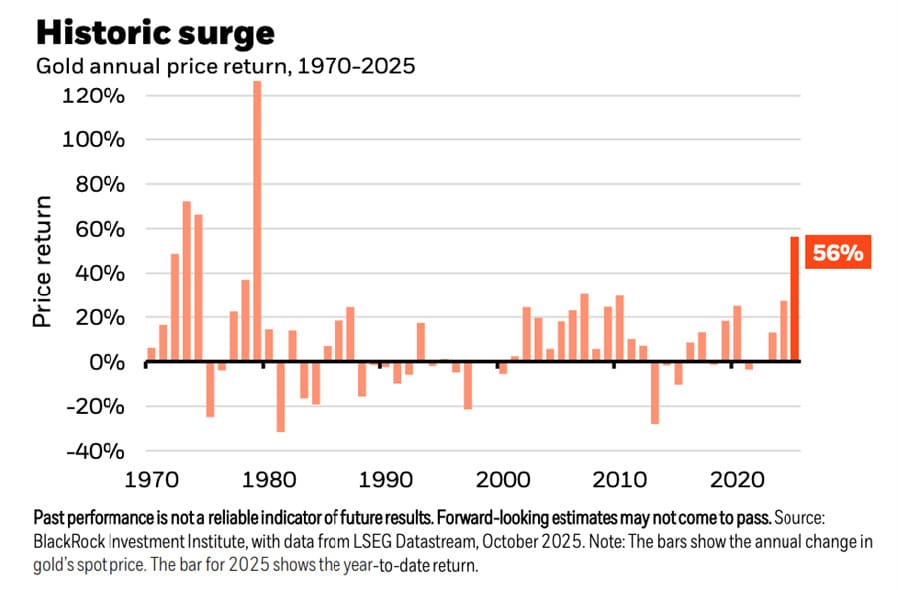

Commodity markets diverged. Gold stood out as the top performer, briefly surpassing $4,400 per ounce before pulling back, marking one of its best annual performances since 1979. The precious metal’s surge was driven by safe-haven flows, rate-cut expectations, concerns about fiscal sustainability in major economies, and strong retail buying interest. Meanwhile, crude oil remained within a range, with Brent and WTI fluctuating between $60 and $65 per barrel, influenced by OPEC+ production adjustments and ongoing demand concerns, especially from China.

US GOVERNMENT SHUTDOWN STALLS GROWTH AND DATA FLOW

The US government shutdown that began on 1 October has so far caused limited market disruption but growing economic strain. Each week of closure is estimated to shave roughly 0.1 percentage point off Q4 GDP growth. The longer it lasts, the greater the threat to labour markets and consumer spending. More so than in previous shutdowns, there is the prospect of lasting workforce cuts and fiscal losses could reach tens of billions if the impasse extends well into November. Past shutdowns suggest that up to a third of lost output may never be recovered. The current one compounds that risk through regulatory paralysis as key agencies (such as the SEC, FDA, and EPA) face funding shortages that delay IPOs, merger reviews, and essential business permits. These bottlenecks are already creating friction for investment and growth. Economists broadly agree that the duration of the closure will determine whether the damage remains short term or becomes embedded in weaker confidence and slower hiring.

MORE SO THAN IN PREVIOUS SHUTDOWNS, THERE IS THE PROSPECT OF LASTING WORKFORCE CUTS

The absence of key economic data has left the Federal Reserve navigating with limited visibility, heightening the chance of policy missteps. High-frequency signals like jobless claims, yield-curve spreads, and consumer confidence measures will offer the earliest signs of deterioration. Investors have turned more cautious and the dollar could come under renewed pressure if the political deadlock drags on.

REGIONAL BANK TURMOIL DEEPENS CREDIT RISK

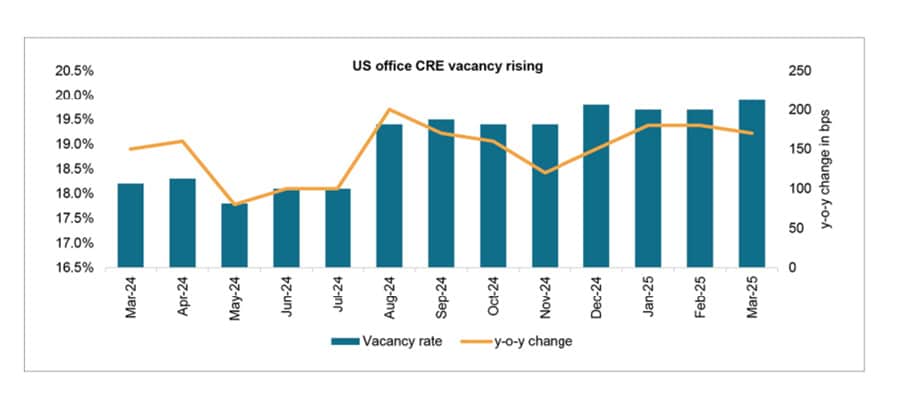

The US regional banking sector has returned to the headlines with Zions Bancorporation and Western Alliance Bancorporation reigniting fears about asset risks across loan portfolios. These failures, compounded by fraud-related charge-offs and elevated loan-loss provisions, triggered sharp volatility in related equities and a market-wide reassessment of regional banks’ exposure to commercial real estate, which accounts for about 44% of their portfolios versus only 13% for major banks. Office loan delinquency rates now exceed 10%, approaching crisis levels due to persistent remote work and falling property values, while a looming maturity wall of loans set for refinancing by year-end poses formidable risks for borrowers facing higher rates.

Although troubles are most severe for smaller lenders, contagion risks persist and the Federal Reserve warns of significant vulnerabilities from $2.1 trillion in credit to non-bank financial institutions, particularly private credit funds with opaque risk profiles. Concentration of distress among regionals could precipitate a credit crunch that ripples through local economies and sectors reliant on relationship banking.

ALTHOUGH TROUBLES ARE MOST SEVERE FOR SMALLER LENDERS, CONTAGION RISKS PERSIST AND THE FEDERAL RESERVE WARNS OF SIGNIFICANT VULNERABILITIES

Despite these sector-wide stresses, the largest national banks—JPMorgan Chase, Citigroup, Goldman Sachs, and Wells Fargo—continue to demonstrate resilience, benefiting from stable deposits and diversified income streams. These institutions are well-positioned to attract customers and acquire struggling rivals. The divergence between strong major banks and pressured regional lenders marks a key structural shift in the US banking landscape.

HELPLINE:

HELPLINE: