VOLATILITY AND RECOVERY

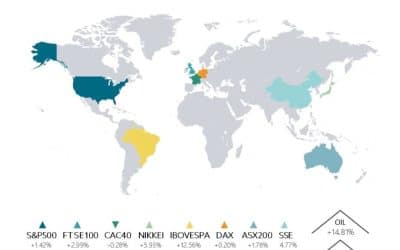

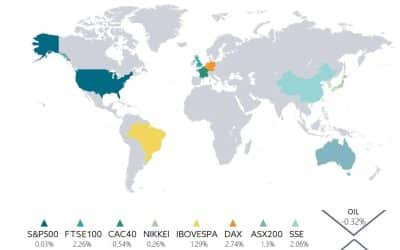

The first half of 2025 was marked by volatility and a notable recovery across global markets. In April, fears over new tariffs led to a severe market downturn, with the S&P 500 dropping by as much as 18% and the Nasdaq plunging 23% for the year-to-date. However, markets rebounded strongly following President Trump’s decision to pause some of the highest tariffs in a century.

By mid-year, equities had become the standout performers, a striking contrast to the steep declines at the start of the second quarter.

Aided by a weakening currency, the US S&P 500 climbed to within 1% of its February high, while the Nasdaq Composite reached an all-time high.Notably, the rally broadened beyond big tech to include financials, industrials, and utilities, reflecting improved market breadth. European markets have proved particularly resilient, with the Stoxx Europe 600 outperforming the S&P 500 by 16 percentage points in dollar terms, its best relative performance since 2006.

EMERGING MARKETS FINALLY BROKE THEIR SEVEN-YEAR STREAK OF UNDER-PERFORMANCE .

During June, the S&P 500 and Nasdaq continued their second quarter gains to finish ahead year-to-date by 6% and 7% respectively.

European stocks lost some momentum during June, with the Euro Stoxx 50 slipping 1%. At the mid-point of 2025, however, the index remains 8% ahead, the FTSE All-Share ahead 9%, Japan’s Nikkei index 2% ahead and China’s CSI index unchanged.

Emerging markets finally broke their seven-year streak of underperformance and reached a record market capitalisation of $29 trillion. Renewed investor interest was driven by broad currency strength against a weakening US dollar and AI-driven growth across Asian markets. Emerging markets appear positioned for continued outperformance as the period of US exceptionalism may be waning.

LONG-DATED BONDS FACED PRESSURE FROM FISCAL DEFICIT CONCERNS.

Fixed-income markets provided stability amid equity volatility, even as concerns grew about US Treasuries losing their safe-haven status due to the erratic policy environment under the Trump administration and concerns about the ballooning US government deficit following Trump’s “One Big Beautiful Bill”, due to be passed by 4 July. Short-dated government bonds performed well as central banks continued cutting rates, while long-dated bonds faced pressure from fiscal deficit concerns. This divergence between short-and long-term yields played out globally, with investors demanding higher compensation for holding longer-duration debt.

Commodities painted a mixed picture. Gold rallied as much as 33% year-to-date, approaching $3,509 per ounce as a weaker dollar provided tailwinds. However, the precious metal lost ground during June, its first negative month this year, hovering between $ 3,300 and $ 3,500. Meanwhile, oil struggled as crude futures hit a four-year low of $55 per barrel in April before recovering due to geopolitical tensions.

Currency markets experienced significant shifts, with the dollar posting its worst start to a year since 2005. The Japanese yen surged almost 9% against the dollar as the Bank of Japan prepared to raise rates while other central banks were cutting. The Chinese yuan strengthened 2% despite tariff pressures, hitting seven-month highs.

OIL PRICE SENSITIVITY TO GEOPOLITICAL SHOCKS

Oil prices were volatile in Q2, with crude futures hitting $55 per barrel in April before rebounding amid rising geopolitical tensions. In June, a major escalation in the Middle East – including Israeli and US strikes on Iranian nuclear and military sites – pushed futures above $80, then down to $64 after a Trump-brokered cease-fire, with intraday swings near 9%. Such shocks have long triggered price spikes, but markets now stabilise faster unless supply is disrupted. About a fifth of global crude flows through the Strait of Hormuz – making it a key risk area– yet no outages have occurred, reflecting stronger resilience and flexibility.

OIL MARKET FUNDAMENTALS REMAIN CHALLENGING DUE TO THE EAGERNESS OF OPEC+ MEMBERS TO EXPAND OUTPUT, US DOMINANCE IN FOSSIL-FUEL PRODUCTION, AND THE RISE OF ELECTRIFICATION AND RENEWABLES.

Looking ahead, fundamentals remain difficult, with OPEC+ eager to expand output, US dominance in fossil-fuel production, and the rise of renewables. Geopolitical tensions continue to fuel volatility, and rising prices still pose inflation risks, though spikes are now shorter and more contained as markets absorb shocks more efficiently.

THE RISE OF CENTRAL BANK DIGITAL CURRENCIES

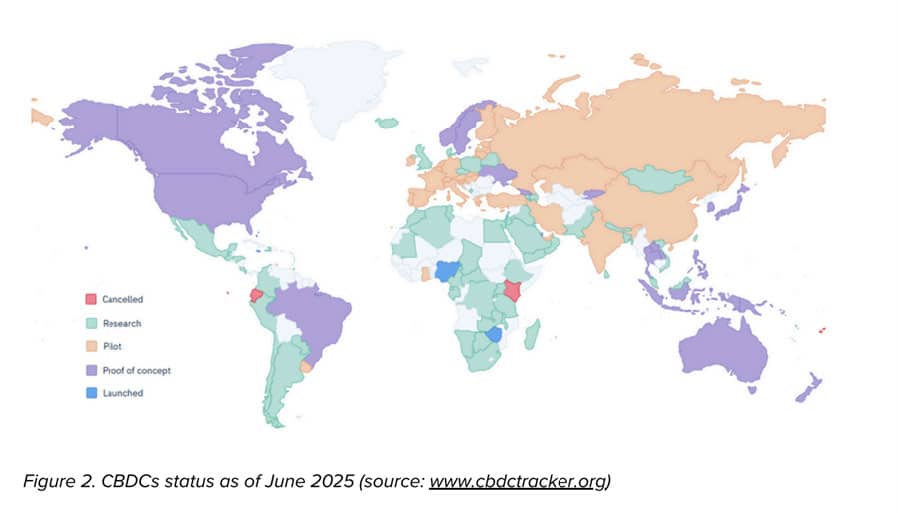

Central bank digital currencies (CBDCs) represent a fundamental shift in how nations approach money in the digital age. Unlike cryptocurrencies, CBDCs are official digital versions of a country’s fiat currency, issued and guaranteed by the central bank. CBDCs are gaining significant momentum. According to the Bank for International Settlements (BIS) 93% of 86 surveyed central banks are now engaged in CBDC-related work.

A KEY DRIVER BEHIND CENTRAL BANKS’ EFFORTS TO CREATE CBDCS IS THE RISE OF PRIVATELY-ISSUED STABLECOINS.

CBDCs come in two main forms: retail CBDCs for everyday consumer use (like China’s digital yuan or Nigeria’s eNaira), and wholesale CBDCs designed for financial institutions to handle interbank settlements and trade tokenised assets. The benefits are clear: enhanced financial inclusion, reduced transaction costs, stronger payment systems, and better monetary policy tools for central banks. While several countries have moved beyond pilots, early implementation reveals both potential and challenges. The Bahamas, Eastern Caribbean, Jamaica, and Nigeria have launched retail CBDCs, but adoption remains limited.

A global geographic divide has emerged in the CBDC landscape. Asian and emerging economies have been the fastest adopters – China’s digital yuan operates across multiple provinces and integrates with major payment apps. South Korea recently completed its “Hangang” pilot with 100,000 users. Russia launched a digital ruble in 2023, and countries like Nigeria, the UAE, and Kazakhstan have movedfrom pilots to live operations.

Western economies have been more cautious. The European Central Bank’s Christine Lagarde is pushing for legislative approval of the digital euro, hoping for a launch decision this autumn. However, she faces resistance from lawmakers worried about the disruptive impact on the traditional banking sector, with estimates of the cost to banks ranging from €18 to €30 billion.

One of the most transformative benefits of CBDCs is expected to be greater financial inclusion, as lower transaction costs could make financial services more accessible to underserved populations worldwide. A digital currency can also reduce identity management requirements in low-risk contexts, enable offline functionality for remote areas, and eliminate the need for traditional bank accounts or minimum balances.

A key driver behind central banks’ efforts to create CBDCs is the rise of privately-issued stablecoins. The collapse of TerraUSD in 2022 highlighted the risks of unregulated digital currencies, prompting central banks to accelerate their own digital currency projects as a stable, government-backed alternative.

Perhaps most significantly, initiatives like the BIS-led Project mBridge – involving China, Thailand, UAE, Hong Kong, and Saudi Arabia – are creating platforms for cross-border CBDC payments that could reshape international finance.

Success will depend on addressing fundamental challenges: digital literacy, infrastructure gaps, robust cybersecurity, and privacy protections. However, CBDCs are no longer theoretical concepts. They are becoming operational realities in much of the world, with the adoption increasingly reflecting broader strategies for financial inclusion and CYBERSECURITY, economic development.

HELPLINE:

HELPLINE: