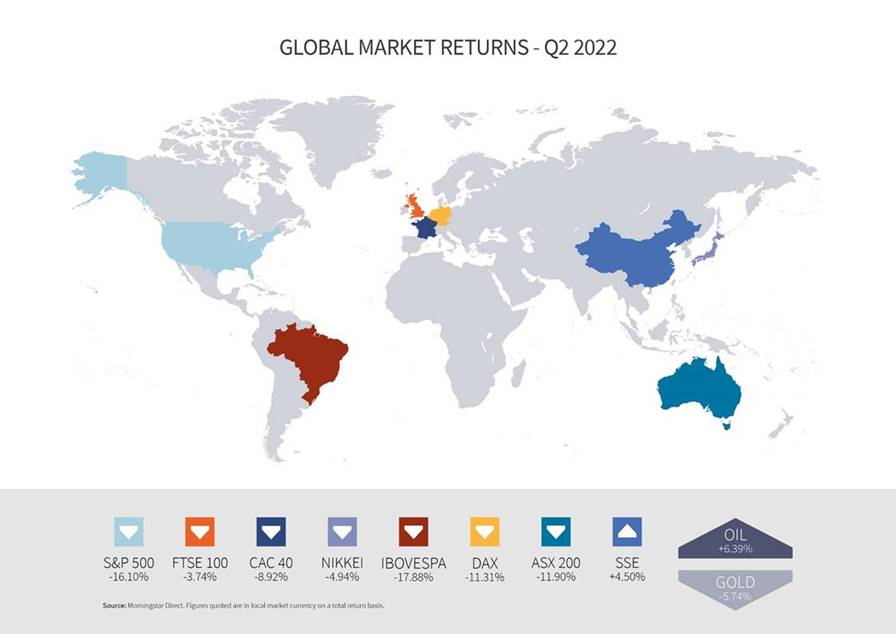

Worst first-half market performance for half a century

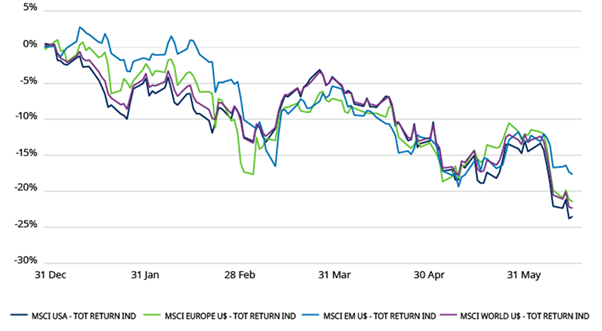

Stock markets notched up their worst first-half performance since 1970 in the face of fears that tackling sky-high inflation may come at the cost of the global economy’s post-Covid recovery.

Recession has become the watchword for investors who dragged down US benchmark indices into bear market territory in extremely volatile market conditions. The S&P500 shed 10% in just one week before recovering some ground towards the end of the month. The index has come off 20% year-to-date and 8% for the month. The Nasdaq saw greater losses, off almost 30% year-to-date and 9% in June.

Elsewhere, the UK FTSE 100 shed 6% and is marginally in the red for the year so far. THE MSCI index of European stocks (ex-UK) shed 8% in June, leaving it 17% down year-to-date. China’s CSI 300 bucked the trend last month, gaining 7%, but still lost 7% in the first half of the year. The Nikkei eased 3%, also leaving it 7% off for the six months.

Stock Markets

Source: Schroders

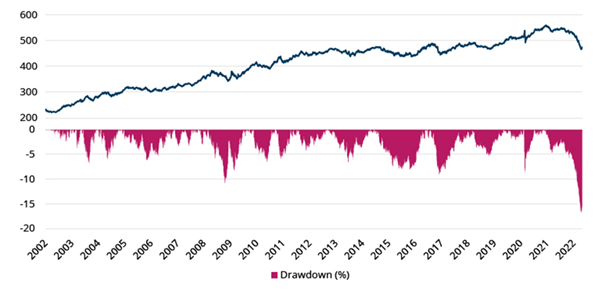

…while bonds fail to provide a safe haven

Bonds have also taken a tremendous hit this year. The benchmark 10-year US Treasury yield has doubled from around 1.50% at the end of last year to above 3%. As a result, many bond indices have fallen in excess of 15% year-to-date. Some long-dated issues, which are particularly sensitive to interest rates, have halved in value over six months—pretty spectacular for a supposedly ‘risk-free’ asset! Some argue that aggressive interest hikes are now sufficiently priced into bond markets and it is time to buy with yields in both the US and Europe higher than their 10-year averages.

As economic growth slows many analysts expect inflation pressures to begin easing and for US interest rates to have peaked by next March at around 3.75%. In this scenario, bonds should regain their appeal as a safe-haven asset, offering a means of reducing overall portfolio risk..

Record decline creating value in bonds

Source: Schroders

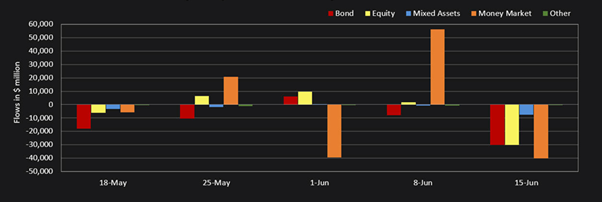

History indicates patient investors will be rewarded

The multi-trillion-dollar selloff in equity markets, concerns about the impact of higher inflation and the increasing likelihood of a recession could all affect company earnings. This has called into question whether it is worth taking on the risk of investing in stock markets or whether it is better to head for safety in other assets or cash. This is apparent in US equity funds, which saw outflows of more than $30 billion in the week ending 15 June – the biggest sell-off since July 2020.

Fund flows: Global equities, bonds and money markets

Source: Refinitiv Lipper data

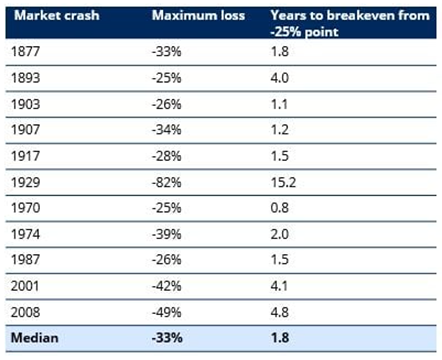

However, history has convincingly shown the benefit of riding out bear markets and momentous crashes with ample rewards for investors that resist giving into panic over short-term circumstances.

Analysis by Schroders based on US equity data since 1877 shows that when stock markets have sold off by more than 25%, investors have usually recouped all losses within two years and on all but one occasion within five years.

Source: Schroders

During the global financial crisis, investors that sold out after their investment had halved in value in the six-month period to March 2009 missed the opportunity of making up those losses by the end of 2009 and going on to enjoy a further trebling of value.

Moreover, the pandemic-induced sell-off in 2020 saw investors nursing year-to-date losses of over 30% by mid-March only to benefit from a full recovery within three months.

There are many well-managed companies built for success that are trading as much as 50% lower than they were at the beginning of the year. Gradual and selective purchasing over the coming months reduces the risk from short-term price fluctuations and provides some insulation from economic shocks. Encouraging signs would include evidence of inflation reaching its peak and the central banks moderating their tone regarding the inflationary threat.

Long the sage of the investment world, Warren Buffett sums up why investors should be investing for the long-term: because the secret to getting rich is to be patient.

Judgement of US Central Bank called into question

The first half of 2022 has seen inflation in many regions rise to its highest level in four decades, a reality that has translated into aggressive interest rate rises. In the US, incremental changes of 0.25% have given way to 0.5% and, most recently, an increase of 0.75%—a sign of how worried the Federal Reserve has become about inflation.

Also notable is that Central Bank economic forecasts have successively been revised downwards at each monetary policy meeting since the end of 2021, casting doubt on the banks’ ability to predict the future trajectory of economic growth and inflation.

Central banks in developed countries have been taken to task for surprising markets with rate moves that have not aligned with their forward guidance. In many analysts’ eyes, this unpredictability has significantly undermined central banks’ credibility, a crucial determinant in the role of monetary policy in controlling inflation expectations. These expectations threaten to entrench higher and stickier inflation, as workers demand higher wages and set in motion a wage-price spiral.

Drawdown in New Horizon strategies cushioned by diversification

Within the New Horizon strategies, bond exposure remains relatively short-dated. This has dampened the impact of the sell-off in fixed income assets due to rising interest rates but broad market losses in bonds have nonetheless acted as a drag on performance. The exception is exposure to emerging market bonds which delivered a positive return in the second quarter and, like emerging market equity indices, are benefiting from the easing of monetary policy in China.

Furthermore, asset-backed and inflation–linked income investments in areas as diverse as health facilities, schools, utilities infrastructure and public/private partnerships have helped the strategies capitalise on positive trends in many income-producing assets without suffering the impact of higher interest rates on long duration, fixed-income investment.

However, it is commodities that have produced the best returns this year and give the clearest example of risk-reduction by diversification. The strategy exposure to precious metals, oil, soft commodities and carbon credits has been carefully selected to minimise the inefficiencies often inherent in these types of investment. Continued strong performance in each of these commodity sub-sectors during periods of equity market weakness has reduced New Horizon strategy volatility and resulted in a shallower drawdown than that of more vanilla strategies focusing on mainstream equity indices and bonds.

This provides a platform to capitalise on a potential rebound in sectors, which have sold off sharply in recent months and now represent a more investable long-term growth opportunity. That process has already begun with some emerging market technology assets and will likely be extended to other markets in the coming weeks.

HELPLINE:

HELPLINE: