MARKETS BRUSH OFF TARIFFS, SHUTDOWNS AND AI JITTERS TO REWARD DIVERSIFIED INVESTORS

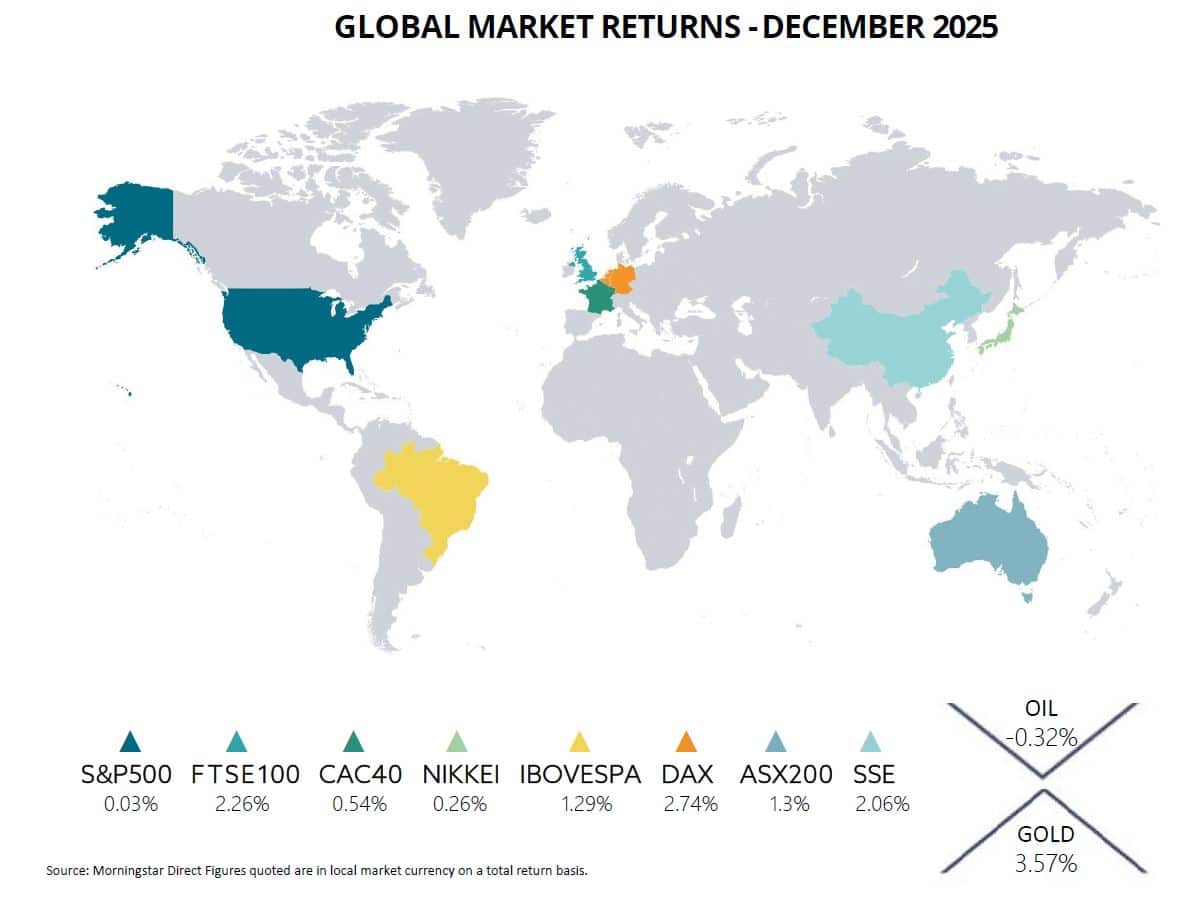

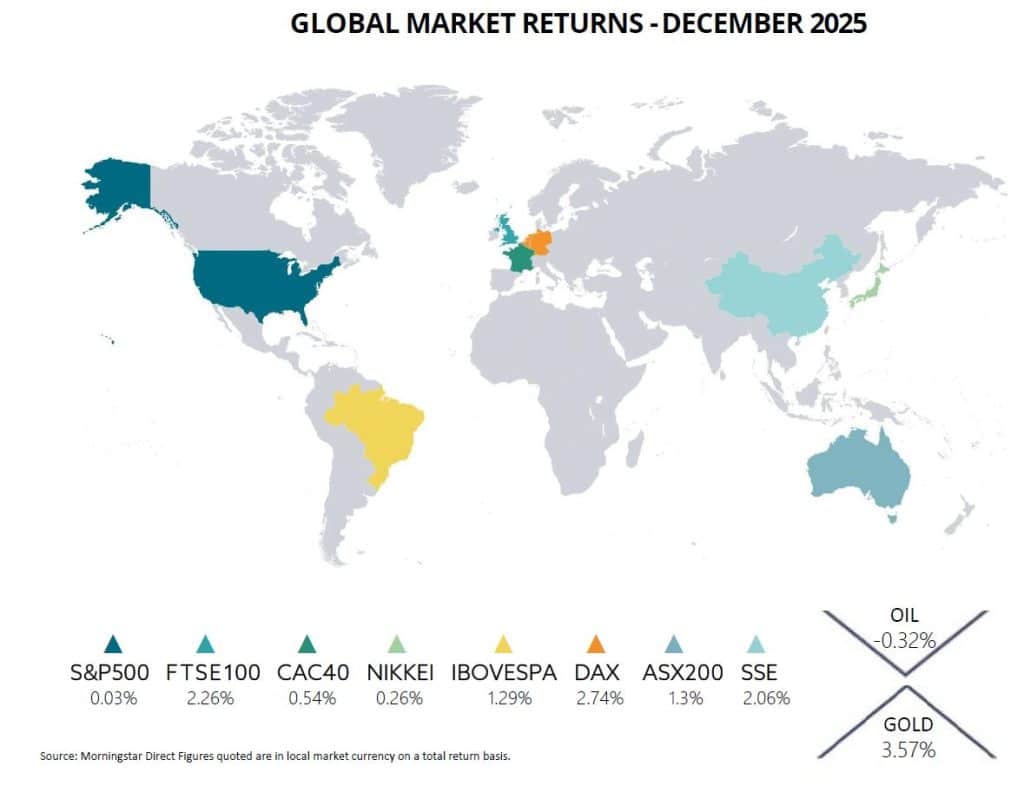

Despite policy uncertainty, geopolitical tensions, and the longest government shutdown in US history, global markets delivered impressive returns across most asset classes in 2025. For the first time since the pandemic, investors saw a rally that rewarded diversification and challenged longstanding beliefs about America’s superiority in equity markets. Global growth held up, calming nervousness around a US recession. Central banks delivered rate cuts as hoped for. And for much of the time, investors focussed on the potential benefits of huge spending on AI rather than the risks. Equity returns by region shifted away from historic trends. For the first time in 20 years, the S&P 500 was the worst-performing major equity market with the 18% produced significantly lower when converted to other currencies. Emerging markets dominated equity market returns, delivering 34% in dollar terms. China’s CSI 300 gained 17%, backed by progress in homegrown artificial intelligence and steady exports despite US tariffs. In Japan, optimism for continued reflation after Prime Minister Sanae Takaichi’s election boosted the Nikkei’s return to 26%. The UK FTSE-All Share and MSCI Europe also finished over 20% higher.

FOR THE FIRST TIME IN 20 YEARS THE S&P 500 WAS THE WORST PERFORMING MAJOR EQUITY MARKET

Global bonds produced divergent performance. US and UK government bond indices produced gains around 5% and yields on US 10-year Treasuries declined by 40bp, the first drop since 2020. However, in Japan the 10-year yield rose by nearly 100bp, the biggest annual jump since 1994. European bond indices were overall little changed but political turmoil resulted in the unusual situation of France yields surpassing those in Italy. German Bund yields spiked on the announcement of fiscal stimulus. Emerging market debt led the fixed-income sector, returning 14% due to strong economic fundamentals and currency appreciation.

At the beginning of 2025, high valuations raised concerns about the sustainability of the artificial intelligence boom that had propelled markets to record highs in 2023 and 2024. The announcement of DeepSeek in China exacerbated concerns and led to a sell-off in the technology sector. Market weakness was compounded by increasing fears around trade tariffs which were realised when, on 2 April, President Donald Trump made his ‘Liberation Day’ announcement. Major stock indices lost about $3.1 trillion in value as investors faced the prospect of tariffs not seen since the 1930s. The S&P 500 plunged nearly 19% from its February peak by 8 April.

Despite this, the market displayed an impressive recovery. Within days of the announcement, some tariffs were suspended, and major equity markets ended the year close to all-time highs. This resilience showed that markets often deliver their best returns when the news seems the most negative.

POLITICAL TURMOIL RESULTED IN THE UNUSUAL SITUATION OF FRANCE YIELDS SURPASSING THOSE IN ITALY

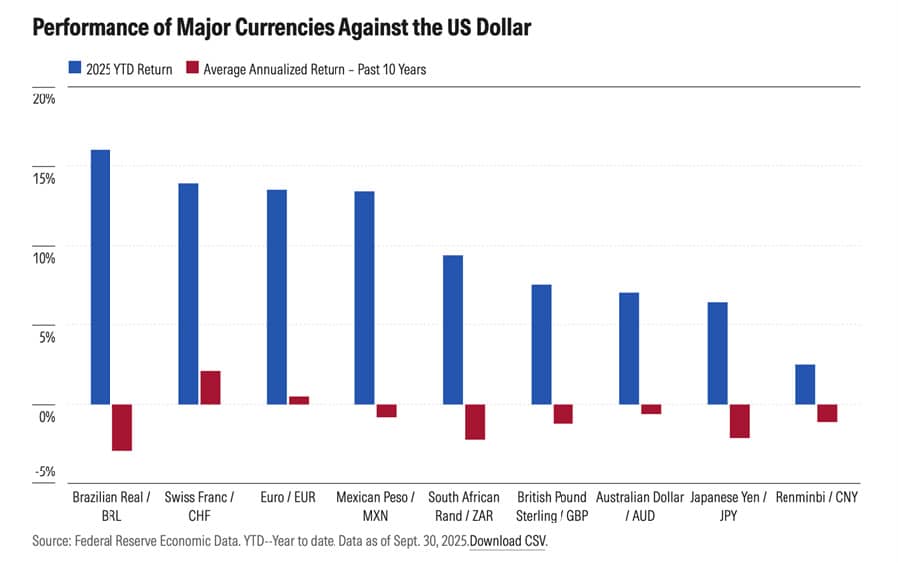

Currency markets reflected changing global dynamics. The US dollar faced its sharpest decline since 2009, falling 7.0% on a trade-weighted basis.

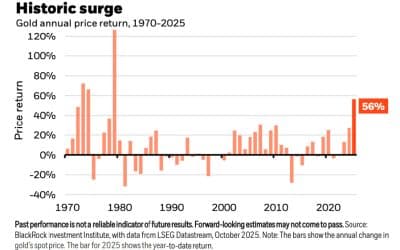

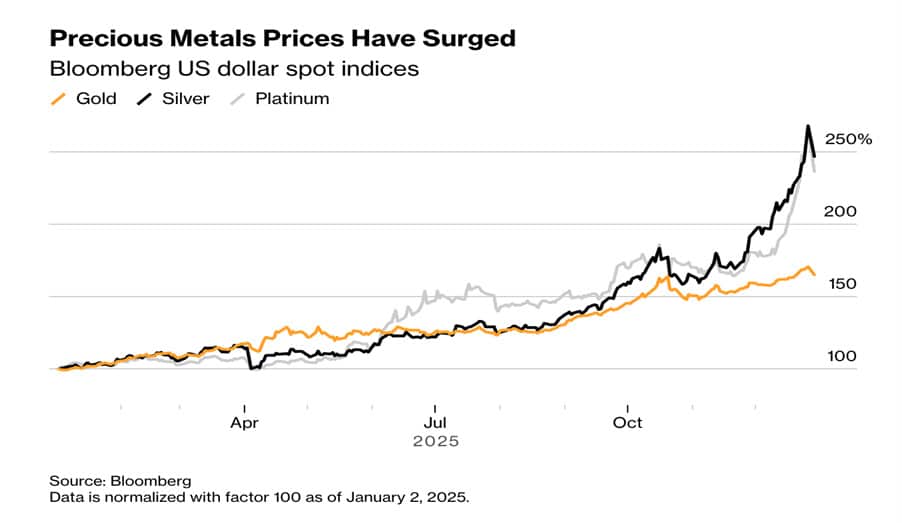

Most notably, precious metals emerged as the standout asset class of 2025. The Bloomberg precious metals index soared 80%, with silver more than doubling in value and gold surpassing the $4,000 an ounce mark, driven by ongoing central bank purchases and demand for safe-haven assets amid geopolitical tensions.

In the fourth quarter of 2025, most financial markets continued to climb. Even with an unprecedented government shutdown, a rise in corporate layoffs, and consumer sentiment lingering near record lows, risk appetite remained strong. Not all strategists were convinced. Bank of America noted that 18 of 20 valuation metrics indicated that the S&P 500 was “statistically expensive” with the index hitting record highs on several measures, including market capitalisation-to-GDP and price-to-book ratios. JP Morgan identified four main risks as markets approached record highs: US power generation capacity, China’s technology capabilities, tensions in Taiwan, and the future profitability of $1.3 trillion in hyperscaler capital spending since 2022.

THE US DOLLAR FACED ITS SHARPEST DECLINE SINCE 2009 FALLING 7.0% ON A TRADE-WEIGHTED BASIS

December wrapped up the year with a four-session losing streak and the S&P 500 was slightly in the red for the month. However, the FTSE 100 and Euro Stoxx 50 managed to gain more than 2% in December and the Nikkei almost 1%. Most strategists predict further equity market gains in 2026, but with extended periods of range-bound trading as corporate earnings growth aligns with high multiples. Analysts pinpoint the key lessons from 2025: diversification proved valuable, currency shifts significantly affected returns, and staying disciplined through uncertainty once again paid off.

REVIEW OF OUR 2025 CRYSTAL BALL

We entered the year no longer guessing whether inflation was under control, but when central banks would ease. In the end, corporate profits were more robust than many feared despite all the warnings of imminent recession, and sentiment held up as periodic inflation shocks, supply chain disruptions, political upheaval, war and geopolitical tensions had already been priced in. Investors ultimately decided they could live with the risks.

GERMANY HAS HAD TO DEAL WITH THE COLLAPSE OF THE “TRAFFIC LIGHT” COALITION (SPD-FDP-GREENS)

Our 2025 crystal ball was intended to be a thought-provoking collection of scenarios rather than an investment playbook. The outcomes were mixed and are reviewed below:

- Sterling will weaken further against the US dollar but recover to $1.25 by year end.

Sterling did weaken initially and recovered to $1.25 in Q1—much earlier than expected—peaking as high as $1.37 in the summer. Much of the recovery was not so much due to sterling strength but to a fall in the US dollar against all major currencies as markets increasingly priced in Federal Reserve interest rate cuts and stronger-than-expected growth in Asia and Europe. - The European Central Bank will get off the fence and cut interest rates.

In the first half of 2025, the ECB delivered four interest rate cuts to 2.15%. The ECB will feel vindicated that GDP remained positive throughout the year. - A member of the European Union will announce a referendum on exiting the bloc in 2025.

This didn’t happen despite the circumstances that could ultimately drive a nation to announce a referendum being very much in evidence. In 2025, multiple French governments fell or narrowly survived confidence challenges as prime ministers struggled to pass crucial budgets and reforms in a divided legislature. Germany has had to deal with the collapse of the “traffic light” coalition (SPD-FDP-Greens), which unravelled over deep disagreements on economic policy, including budget and debt rules, and ultimately led to a snap election.

- Gold will recapture highs around $2,800 per ounce.

Gold reached $2,800 in early April (about the same time global equity markets were panicking over trade tariffs) and continued rallying strongly. - Oil will rise to $95 per barrel.

The anticipated buoyant US economy materialised but this did not translate to a sustained rise in the oil price as record US output led to oversupply and OPEC production cuts were lifted. - The Russell 2000 Index hits 2,600.

The index hit 2,590, 10 points short of the target. As predicted, the gain was not at the expense of the Magnificent Seven (the seven highest-performing tech companies, including Amazon, Apple, Microsoft and Alphabet (Google)). - Another difficult year for Chinese markets.

In early April, the Chinese market plunged after the US and China announced sweeping tariff increases against each other. The recovery, though, was impressive and owed much to government support and stimulus. There was also a shift in the market away from exports to technology and AI which attracted international capital. - The Bank of Japan will raise interest rates without collapsing their own stock market.

The Bank of Japan raised interest rates twice in 2025, from 0.25% to 0.75%. The yen ended the year pretty much as it was at the start at Y157 to the US dollar and the Japanese stock market marched on to an all-time high of 51,000. - Bitcoin reaches $150,000.

This was going well from January to October with the price rising from 95,000 to 126,000. However, this was enough to trigger profit-taking as the market became more risk averse and gold continued to attract buyers seeking a store of value. - A major company, like BP, will de-list from the FTSE and move to New York.

AstraZeneca, the UK’s largest pharmaceutical company and a major FTSE 100 component, announced plans to list its ordinary shares directly on the New York Stock Exchange, while retaining a London listing for now. Diversified Energy Company, nowhere near as big as BP but in the same sector, announced that it would move its primary share listing to the New York. There are others, such as CRH plc, an $85 billion company which confirmed plans to recommend moving its primary listing to the US as well. More may follow in 2026.

IN CHINA THERE WAS A SHIFT IN THE MARKET AWAY FROM EXPORTS TO TECHNOLOGY AND AI

THE CRYSTAL BALL FOR 2026 GIVES US

- US SMALL AND MID-CAP STOCKS WILL OUTPERFORM LARGE CAPS

They had a good run in2025, but the valuation discounts on price-to-book and price-to-earnings to large caps are still in place. In addition, the protectionist policies implemented by the Trump administration should underpin a favourable environment for companies much more heavily reliant on the domestic market. - THE UK 10-YEAR GILT YIELD WILL HIT 5%

The Bank of England appears to be slowly waking up to the fact that the UK economy is stagnating while it is still fighting yesterday’s battle against inflation. The Monetary Policy Committee is split on whether to cut rates, but the market is expecting another couple of quarter-point cuts in the months ahead. They may find that the bond market, and foreign investors in particular, will demand a higher yield for continuing to lend to a government presiding over an economy in trouble. Base rates may well come down, but the 10-year yield will not necessarily follow. - INFLATION WILL REMAIN ABOVE 2% IN THE US AND UK

The Federal Reserve has become more cautious in easing monetary policy. With core inflation above 2%, often in the range of 2.5% to 3%, the Fed is more likely to delay or limit further rate cuts. In addition, tariffs and trade costs are likely to continue to filter through to consumer prices. - GOLD WILL FALL TO $4000

A little profit taking would be justified following a terrific run in 2025 which saw the price of gold rise 70% from $2,625 to $4,487. Impressive for an asset with no yield. While it is still regarded as a classic safe haven, if geopolitical tensions ease (Ukraine and Middle East) demand could weaken. There could also be pressure from the effect of a stronger, or just a stable, US dollar. - THE PRICE OF OIL WILL BE BELOW $65 A YEAR FROM NOW

One of the strongest bearish forces on oil prices is supply outpacing demand, as we saw in 2025. The US Energy Information Administration is not alone in forecasting this situation to continue with inventories building. In addition, demand growth projections remain weak compared with supply growth, partly due to recent slowing economic activity in some major markets. - COPYRIGHT UNCERTAINTY WILL DERAIL THE AI JUGGERNAUT

The model of “training on everything on the internet” is running into lawsuits, new regulations and probably a wave of court rulings to decide whether AI firms can keep using copyrighted books, articles, code and images without permission or payment. If they can’t, that could force a messy, expensive pivot to licensed data and royalties. That shift would hit profit margins hard, scare off some investors, and likely leave only the well capitalised players standing. - STERLING WILL WEAKEN IN 2026 AND END THE YEAR APPROACHING $1.20

Most commentators are talking of the US dollar continuing to weaken but the Bank of England may well cut interest rates more aggressively than the Federal Reserve due to weak economic growth. UK economic momentum is projected to slow further in 2026, with slower wage growth, weaker household incomes and subdued business investment. The high-end UK property market is also under a lot of pressure. Even if the Fed cuts later, the timing and scale may leave the interest rate gap favouring the dollar for much of 2026, making such a substantial sterling weakening plausible. - FRENCH GOVERNMENT COLLAPSES LEADING TO A SNAP ELECTION

It’s always dangerous to predict politics but France has been in deep political gridlock since snap elections in June 2024 produced a fractured National Assembly with no party holding a clear majority. It is also heading into the new year without an agreed state budget after the lower house failed to pass the 2026 budget, forcing emergency or “rollover” finance laws just to keep the government operating. A fiscal crisis would be highly unusual and unsettle both markets and other EU members. - SIR KEIR STARMER WILL REMAIN PRIME MINISTER IN 2026

There seems to be a genuine belief that he could be out. However, even if polls fall sharply, the party doesn’t tend to remove leaders mid-term without extraordinary circumstances. Labour’s internal rules require significant support from MPs, at least 20% of the parliamentary party, to trigger a leadership contest. That’s a high bar. - BULLISH JAPANESE STOCK MARKET ISN’T FINISHED YET AND THE NIKKEI 225 EXTENDS TO 55000

The index rose 26% in 2025 despite the Bank of Japan delivering two quarter-point interest rate rises. But the yen is still relatively weak against the US dollar, which has historically been supportive of exports. In addition, valuations are still reasonable against their global peers and there is evidence that global investors are still underweighting Japanese equities relative to the market size. This re-engagement will likely continue into 2026 because long-term reallocations tend to play out over years, not months. Unlike many Japanese stock market rallies in the past, this one is less speculative and more about structure. Unless there is a sharp policy mistake, global recession, or sudden yen surge, the conditions that started the bull market do not yet look exhausted.

HELPLINE:

HELPLINE: