TECH SHARES WOBBLE ON AI BUBBLE FEARS

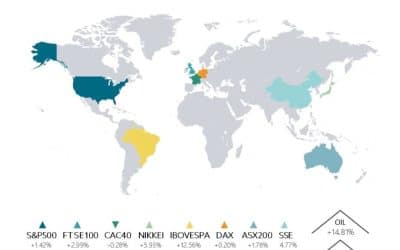

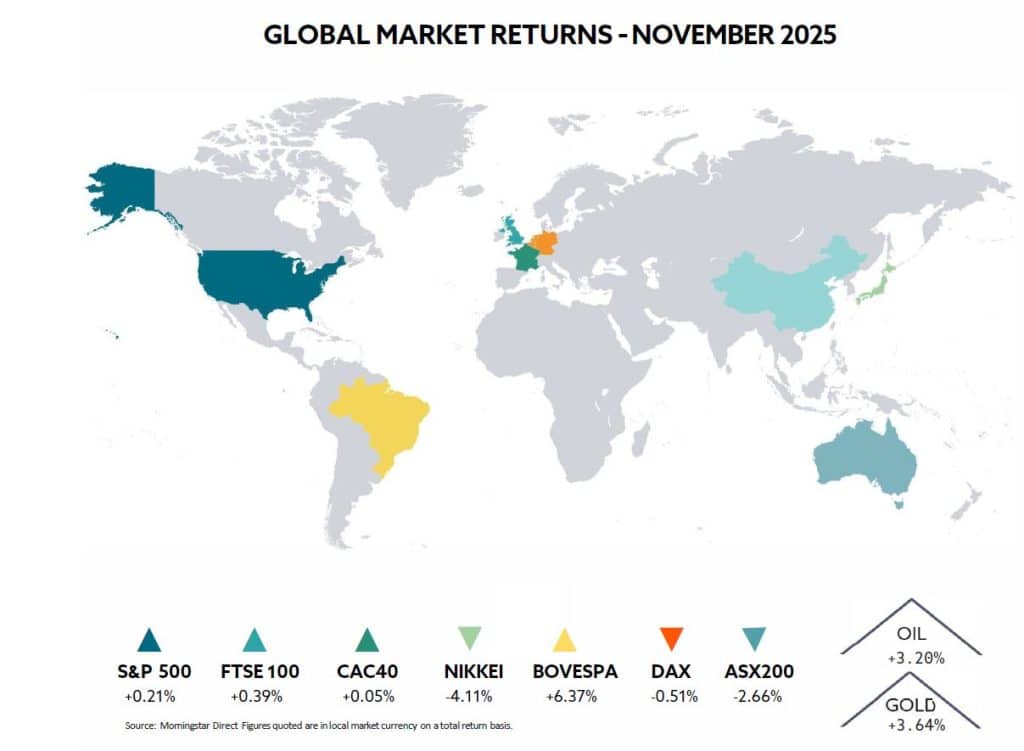

November was a month of two distinct phases in global markets, with an initial risk-off selloff followed by a sharp recovery that left headline indices little changed. Rapidly shifting expectations around a December Fed rate cut, worries about an AI-driven bubble, and signs of a rotation away from mega-cap tech into smaller caps and safe havens defined the period. European and UK assets held up relatively well against a more fragile backdrop in China and cryptocurrencies.

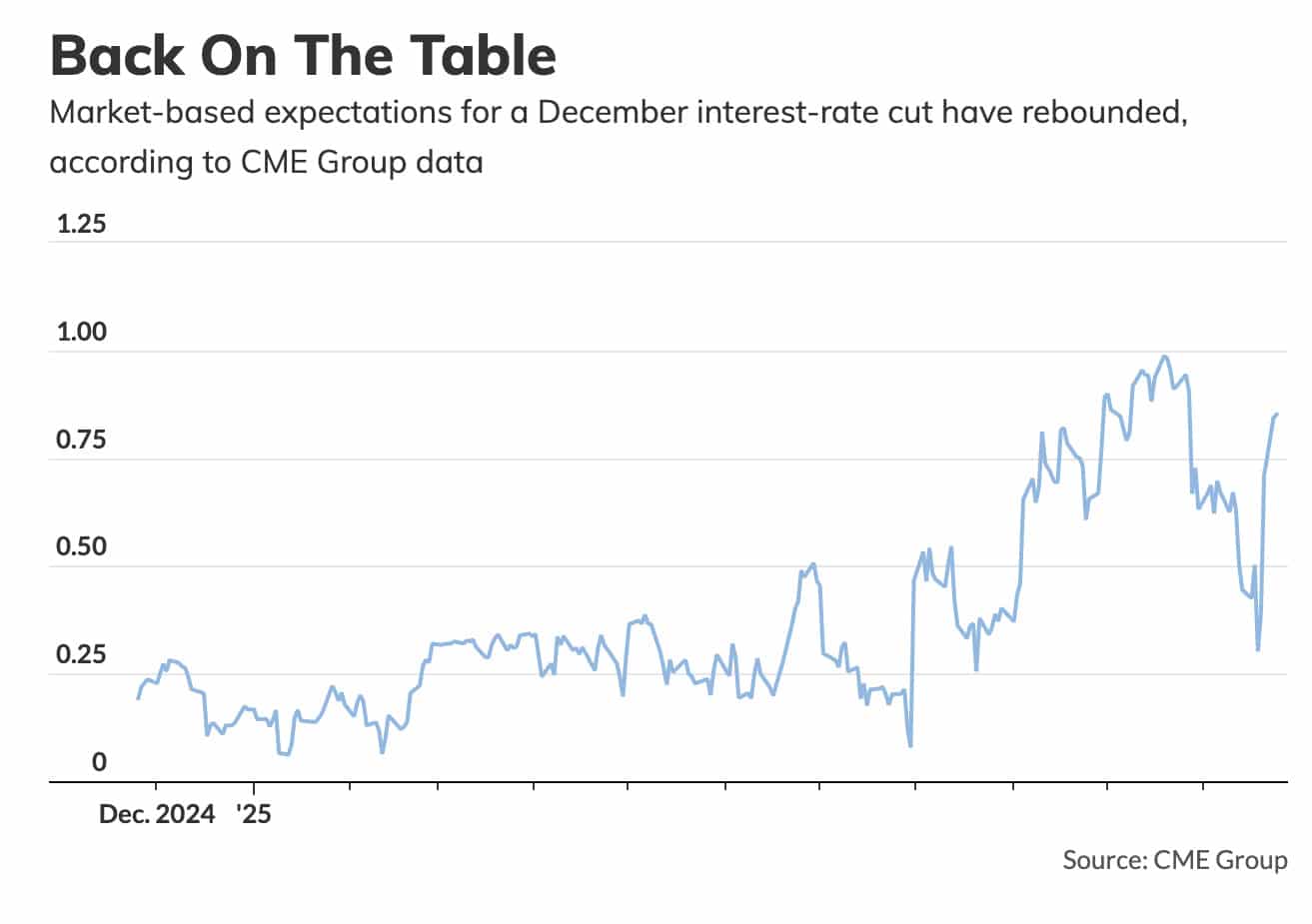

FED FUNDS FUTURES SHOW A 90% CHANCE OF A 25-BASIS-POINT (US) CUT IN DECEMBER

The US has entered December with markets expecting a rate cut, despite an unusual data gap caused by the longest-ever government shutdown. The October CPI and jobs reports were cancelled, leaving the Fed to set policy with limited new inflation information. Still, Fed funds futures show a 90% chance of a 25-basis-point cut in December, with markets increasingly expecting an easing cycle that could last well into 2026.

US Treasuries rallied through mid-November, with 10-year yields falling to about 4.07% on 13 November, down from peaks above 4.5% in October, as shutdown resolution and rising rate-cut odds increased demand for duration.

In the UK, the Bank of England held the Bank Rate at 4.0% in early November, but the 5-4 vote to keep rates steady, with four members favouring a cut, was seen as dovish. UK gilts rallied into the Autumn Budget, with 10-year yields falling to around 4.45% by late in the month, extending a 30-basis point decline since late October. The FTSE 100 remained near record highs for much of the month, supported by energy, mining, banks, and dividend yields near 4%.

CONTINENTAL EUROPEAN EQUITIES MARKED TIME AS THE ECB MINUTES FROM OCTOBER REVEALED A STRONG PREFERENCE TO KEEP RATES STEADY

Continental European equities marked time as the ECB minutes from October revealed a strong preference to keep rates steady and maintain optionality.

China remained the global outlier. The official manufacturing PMI increased slightly but remained in contractionary territory at 49.2 in November, marking a record eighth consecutive month below 50. Fixed-asset investment for the first ten months dropped about 1.7% year-on-year, the worst on record, reflecting ongoing weaknesses in property and infrastructure. The China SSE Composite declined 2.2% over the month.

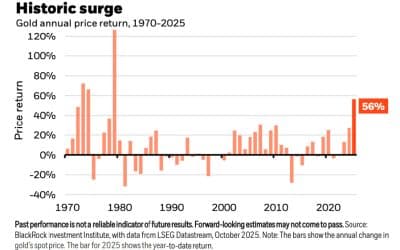

Safe-haven flows helped gold hit a new high of $4,260 while oil prices fell, with WTI below $60 per barrel, down 12% so far this year. The market is focussing on increasing non-OPEC supply and possible resolution in Ukraine.

Cryptocurrency markets plunged with Bitcoin dropping from early October’s record highs above $126,000 to below $85,000 by mid-November. The selloff was caused by ETF outflows, derivatives deleveraging, and broader concerns about AI and tech valuations.

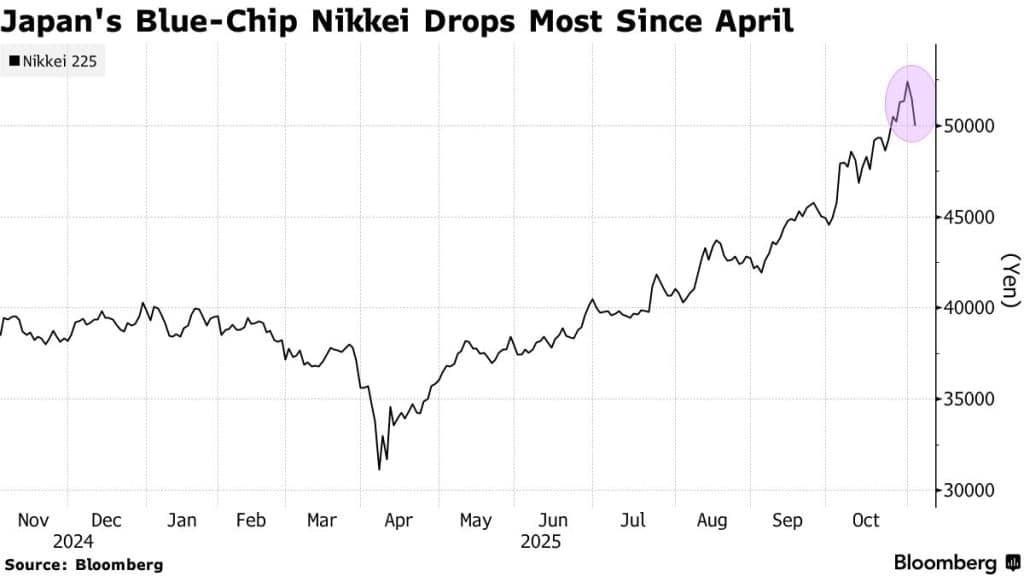

VOLATILITY IN JAPANESE MARKETS AS INVESTORS ASSESS STIMULUS MEASURES AND REFORMS

Japanese financial markets are becoming more volatile, as investors reassess valuations and fiscal health. The equity market has seen significant swings, including a 4.7% one-day decline in early November for the Nikkei, with SoftBank Group dropping 10% and chip equipment manufacturer Advantest declining 6%. Although prices remain substantially higher than at the start of the year, thanks to corporate governance reforms, buybacks, and better earnings, the recent volatility shows that investors now want more solid evidence of real returns from AI-related investments.

A significant development has been the sharp rise in Japan’s bond market. The 10-year Japanese government bond yield has reached 1.8%, a multi-decade high and a clear contrast to the sub-1% levels seen during the Bank of Japan’s yield curve control. This revaluation is driven by several factors: the BoJ’s slow move toward normalising monetary policy, increased foreign investor interest across the yield curve, and rising concerns about fiscal sustainability amid Prime Minister Sanae Takaichi’s government’s stimulus plans.

THE MARKET IS FOCUSSING ON INCREASING NON-OPEC SUPPLY

Although markets initially responded positively to Takaichi’s focus on reviving the economy and fostering growth, concerns have grown around subsequent falling government bond prices and a weakening yen. These signal that investors are growing more cautious about debt issuance and persistent inflation. With public debt exceeding 230% of GDP, balancing economic stimulus with fiscal credibility has become even more complicated.

Looking ahead, the medium-term outlook remains positive. Real wages are beginning to rise as nominal wages increase faster than inflation and this should boost consumer spending. The BoJ seems comfortable keeping its policy rate at 0.5%, while encouraging more market-driven price discovery in bond and currency markets. Structural reforms continue to support Japanese corporations, with ongoing improvements in governance and capital efficiency. However, the near-term outlook is likely to remain volatile as the country shifts from an era of low rates to a more normalised policy environment.

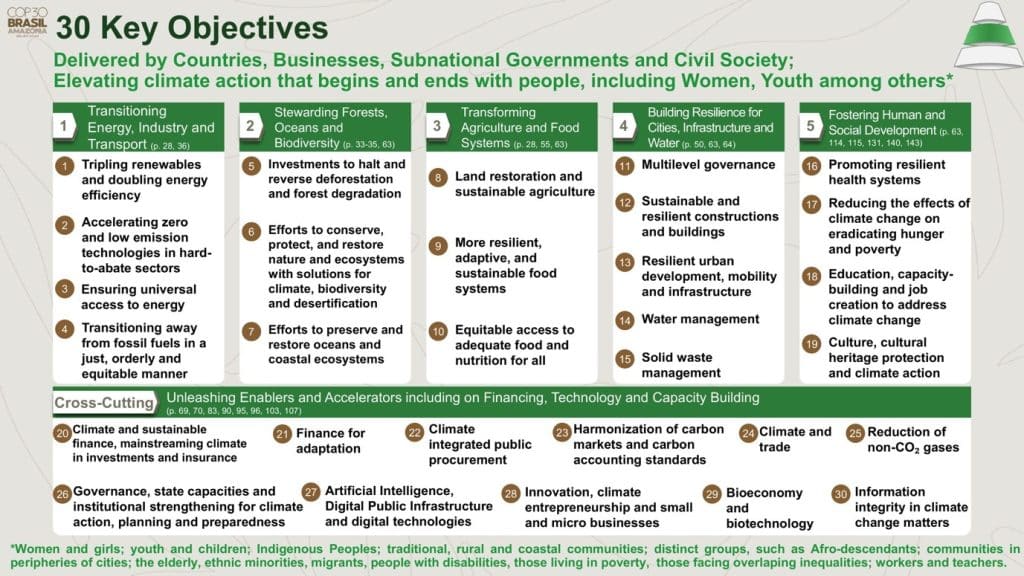

LIMITED PROGRESS AT COP30

In essence, COP 30 was a climate summit that preserved process but disappointed on progress. The 2025 UN Climate Conference in Belém, Brazil, was not without problems, which included a fire and full evacuation of delegates, causing major disruption to meetings, transport and flight schedules. Once the conference resumed, it delivered outcomes that aptly reflect the current tension in global climate governance: enough progress to sustain multilateral cooperation, but not enough ambition to address the scale and urgency of the climate crisis. There was one symbolic win: the Global Mutirão deal, which commits countries to tripling adaptation finance by 2035, supported by initiatives to turn promises into more bankable projects in emerging-market.

THERE WAS NO BINDING AGREEMENT TO PHASE OUT FOSSIL FUELS, AS PRODUCER COUNTRIES BLOCKED EXPLICIT LANGUAGE

However, there was no binding fossil-fuel phase-out, as producer nations blocked explicit language, keeping policy uncertainty high. Many finance pledges are long-dated, rebadged or use soft wording around “efforts”, raising doubts about how much new capital will materialise. For investors, the adoption of global indicators to track adaptation progress is notable, offering more clarity and standardisation for risk assessment. Overall, COP30 underlined a continuing disconnect between what science says is needed to keep 1.5°C “within reach” and what governments are willing to do. This means climate and transition risks remain under-addressed at the policy level and investors still need to do much of the risk assessment and pricing work themselves.

HELPLINE:

HELPLINE: