EQUITY MARKETS REACH NEW HIGHS DESPITE CAUTION OVER RATE CUTS

The first quarter of the year was characterised by several stock markets hitting all-time highs but with the Magnificent Seven tech stocks no longer driving market performance to the same extent as in 2023. Inflation in the US was persistently elevated, the US economy remained resilient, and investors are now pricing in fewer rate cuts this year which made for weakness in bond markets. Commodity price performance was varied but the gold price reached a new high.

New Horizon strategies make good progress

Strongest contributor to the New Horizon portfolio gains was Dutch semiconductor industry supplier, ASML, which ended the quarter 40% higher. Momentum strategies performed strongly, appreciating by over 20%. Exposure to this factor, as well as US technology exposure, was marginally reduced in the portfolio to lock in gains. Overweight exposure to Indian and Japanese equities also produced double-digit returns.

Most of the laggards were from income investments and portfolio exposure was trimmed to index-linked bonds and short- dated sterling exposure as the outlook on rate cuts moderated. Infrastructure and warehouse property registered double-digit falls, but portfolio exposure is maintained to

capitalise on an anticipated rebound after initial interest rate cuts. Palladium, platinum, and carbon offset markets all continued to show weakness and New Horizon portfolio exposure was reduced to each in January.

Targeted exposure to the healthcare sector registered modest gains after underperforming broad equity indices by over 15% during 2023. Exposure will be increased in the portfolio on further signs of positive momentum. Valuations are at multi- year lows. Spend on biotech innovation and the potential benefits have yet to be reflected in share prices and the large pharma stocks continue to produce strong returns on invested capital.

Encouraging signs for stock markets

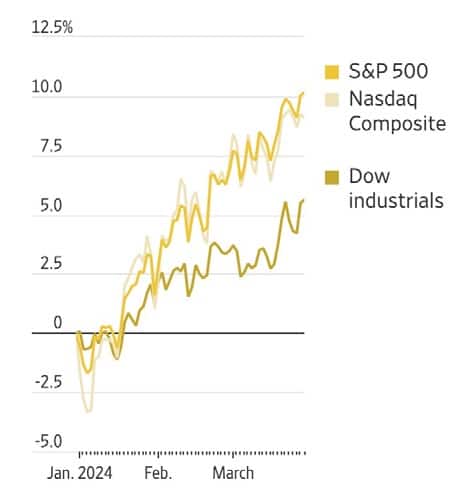

The S&P 500 Index rose 10.6% during the first quarter, its strongest start to the year since 2019. Historically, a first quarter that has delivered more than 8% has resulted in a positive year 94% of the time, with the average return 9.7% in the remaining quarters, according to Dow Jones Market Data analysis.

Index performance

Source: Factset

Some analysts believe there is cause for concern at these levels, but earnings have been robust, the US economy is still stronger than expected, and interest rates are still expected to decline this year despite inflation having ticked up in recent months. The elections in the US and UK are also expected to provide a fillip to stock markets, given a history of positive equity markets during an election year.

The UK FTSE All Share Index added 3.6% in the first quarter, lagging its developed market counterparts but rising 4.2% in March and outpacing the S&P 500 gain of 3.2%.

Some analysts anticipate a brightening of equity market fortunes in the UK with it having trailed other developed market stock markets over the past few years.

Meanwhile, the Nikkei index gained over 20% in local currency terms, but the return was significantly lower when converted to other currencies. China’s stock market remained in the doldrums as investors fret about property woes and what lies ahead from a regulatory perspective. However, the CSI 300 Index did manage to eke out a 0.5% advance in the first quarter.

Anticipating interest rate cuts and earnings growth

Switzerland led the way in lowering its interest rate in March as investors’ expectations on the trajectory of interest cuts in the US finally aligned with the steer provided by the Central Bank. Three rate cuts this year are now implied by market pricing rather than the six indicated at the start of the year. The consensus is that the first cut is likely to come in June in the US and the EU but may not be until August in the UK. The focus is soon expected to shift to the terminal rate rather than the pivot point in the rate cycle.

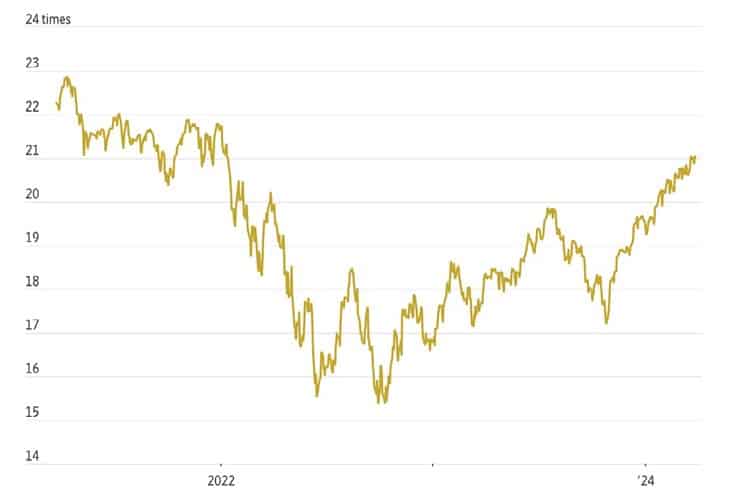

Against the backdrop of a more conservative and realistic outlook for interest rates this year, equity investors will be looking for evidence that corporate earnings will justify the current higher-than-historical-average market valuations.

The consensus analyst view is for a 3% increase in company profits in the first quarter of this year – a third quarterly positive earnings season in a row — and earnings growth is expected to come in at 11% this year. The S&P 500 is trading at about 21 times future earnings over the next 12 months, higher than the five-year 19 times average but lower than it has been in recent years.

S&P 500 price/earnings, next 12 months

Source: Factset

Positive performers this quarter are likely to be the utilities, information technology, communication services, and consumer discretionary sectors while energy and materials sectors are expected to be negative.

If earnings surprise to the upside again, it will be difficult for the Fed to justify even three cuts this year without a levelling out in inflation.

Election impacts

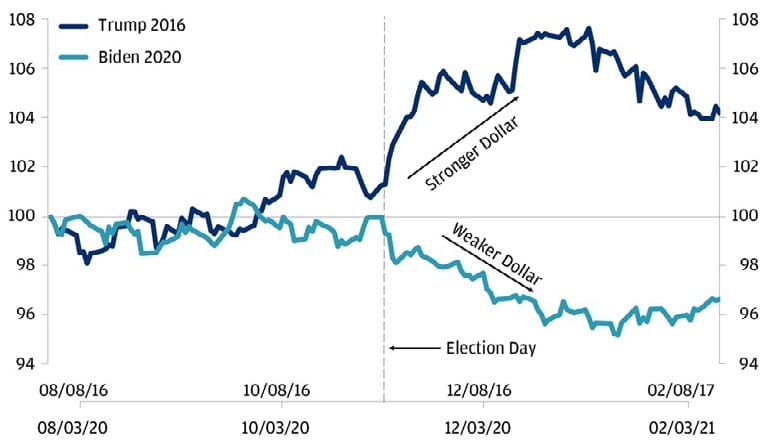

Election years have historically seen stock markets rise. However, the US election, a rerun of Biden versus Trump, contains the potential for surprises. Donald Trump’s

previous presidency highlighted the impact he could have on the macro-economy and the geopolitical landscape, but it could be greater with more preparation this time round.

A Trump win is expected to result in higher tariffs and a stronger dollar. Trump states that he would impose universal 10% baseline tariffs on all imports except from China where the tariff would rise to 60%. These would impact the profit margins of importers of goods, particularly those from China.

The last two elections had a noticeable impact on the U.S. dollar Indexed; August 8, 2016 and August 3, 2020 = 100

Source: JP Morgan

A trade war arising from increased US tariffs on China under Trump could be a headwind for stocks but is unlikely to stop the AI boom. A Trump win would also likely bring extended tax cuts and a boost to aerospace, defence, financials, and small-cap stocks. A combative approach to foreign relations will add to geopolitical tensions. Biden is more likely to maintain electric vehicle subsidies and focus on renewable energy and healthcare.

Dow Jones data going back to presidential elections after 1950 shows that 83% of the time the S&P500 has risen by an average of 7.3% in that year. However, currency markets are already pricing in high volatility after the elections. Current betting odds imply the race is too close to call. Whoever wins, a divided Congress would make it harder to implement policy.

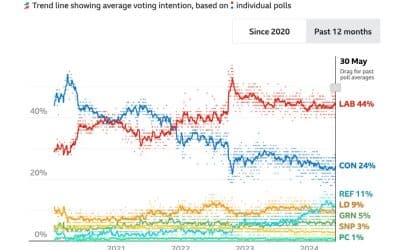

In the UK, a Labour Party win in an autumn election seems likely, based on current opinion polls. The UK stock market needs a catalyst to decisively break out of its slump, and some investors hope a Labour government may provide it. Currently, UK stocks are trading at a 35% discount to global peers – the widest discount in decades and a turnaround from the premium they traded at before 2016.

UK stocks: cheap but not cheerful

Gap between price/earnings valuation of UK’s FTSE 350 and world stocks

Source: LSEG

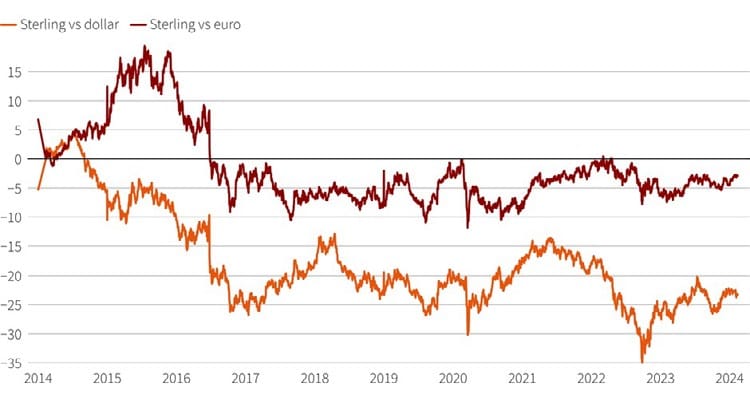

Business confidence has declined in recent years with Brexit contributing to a reduction in the country’s growth rate and weighing on trade. A Labour government is expected to result in closer ties to Europe which may prove positive for sterling after years of underperformance since Brexit.

The pound’s post-Brexit slide

How sterling has performed vs the dollar and the euro (%)

Source: LSEG

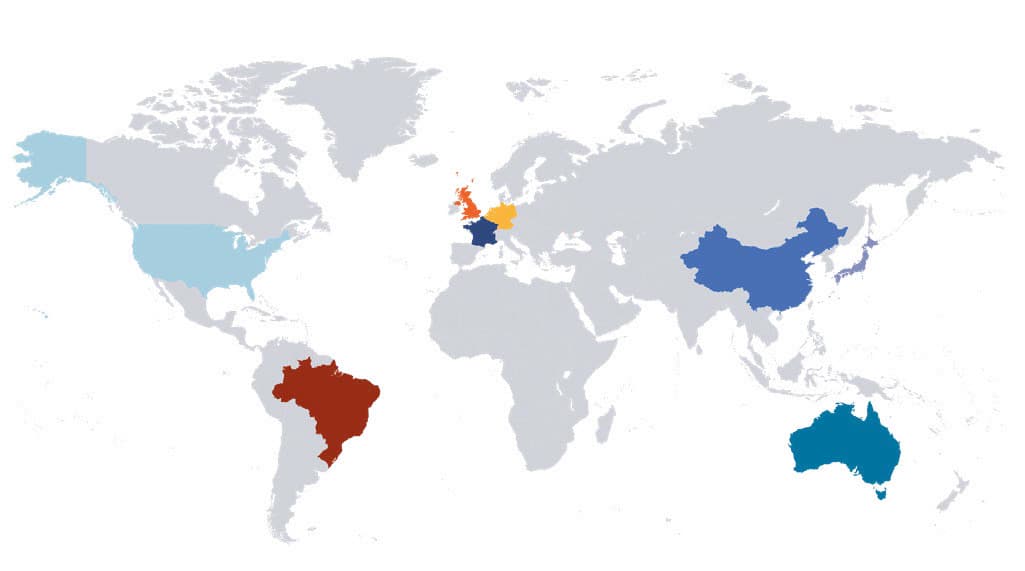

Labour policy on tax rises has shifted in the past year and a Labour government is now expected to show restraint on taxes, introduce infrastructure planning reform, and bring more private investment into public projects. It may also build on moves by the Conservative government to encourage an increase of investment by UK pension schemes into UK equities. While pension funds in many countries, such as France, Italy, Australia, Japan, and the US include a weighting to domestic stocks of over 25%, estimates for the percentage allocation in the UK range from 2% to 6%. Thirty years ago, insurance and pension fund investment accounted for nearly half the investment in UK listed equities. That figure is now under 4%. A reversal of this trend, induced by government legislation, would provide a huge boost to the UK small and mid-cap equity markets.

GLOBAL MARKET RETURNS Q1 2024

IMPORTANT INFORMATION

This document has been compiled for information purposes only. It is intended for professional intermediaries only and does not take into account the needs or circumstances of any person or constitute advice of any kind. It is not an offer to sell participatory interests or an invitation to invest in any product. The information contained herein has been inserted in good faith from sources believed to be reliable, but no representation or warranty, express or implied, is made as to its accuracy, completeness or correctness.

New Horizon portfolios are provided to advisers and documented monthly. They are designed to seek to achieve a stated investment objective within certain general risk parameters. Any additional information provided from time to time, including general opinions about investments or markets, guidance about the risks associated with investments, or assistance with financial promotions or execution, should not be treated as a personal recommendation and is not intended as such.

Any investment in a portfolio strategy may outperform or underperform the average client portfolio and corresponding benchmark. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency-denominated securities. Investments or investment services referred to may not be suitable for all recipients. The price of an investment will depend upon fluctuations in financial markets outside anyone’s control. The performance record of model strategies is hypothetical and results have many inherent limitations. There are frequently sharp differences between a hypothetical composite performance record and the actual record subsequently achieved. One inherent limitation on results is that the allocation decisions reflected in the performance record were not made under actual market conditions and, therefore, cannot completely account for the impact of financial risk in actual trading. Certain sections in this document may contain ‘forward-looking statements’. Examples of such statements include the words ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘believe’, ‘should’, ‘intend’, ‘plan’, ‘could’, ‘would’, ‘probability’, ‘risk’, ‘target’, ‘goal’, ‘objective’, ‘may’, ‘might’, ‘if’, ‘endeavour’, and similar expressions or variations of these expressions. These statements are based on current plans, estimates, targets and projections, and are subject to inherent risks, uncertainties and other factors which could cause actual results to differ materially from the future results expressed or implied by such forward- looking statements. None of these forward-looking statements represent guarantees in any form. The value of investments and income from them may go down as well as up and is not guaranteed. Investors in the portfolios presented may, therefore, not get back the amount originally invested. Past performance is not necessarily a guide to future performance. Further information about investment risks is available on request.

New Horizon Asset Management IC Limited and its affiliates accordingly accept no liability whatsoever for any direct, indirect or consequential loss arising from the use of this document or its contents. New Horizon Asset Management IC Limited is licensed by the Guernsey Financial Services Commission and is registered in Guernsey with company number 70518. Registered Address: Third Floor, La Plaiderie Chambers, La Plaiderie, St Peter Port, Guernsey, GY1 1WG

HELPLINE:

HELPLINE: