It is sometimes said that economists add a decimal point to their forecasts to show they have a sense of humour. But in truth, despite being an inexact science at the best of times, economic data is routinely accepted as an accurate measure of the economy.

This is particularly the case with the notoriously tricky job of measuring and forecasting Gross Domestic Product (GDP). Given the complexities of a modern economy, measuring the total value of all of a country’s goods and services is never going to be precise and, of course, is subject to revisions months after the initial release. Analysts and investors need the data for forecasting, but really GDP is not a terribly reliable rear-view mirror because it is always work-in-progress.

However, what is clear is that the US is bouncing back faster and stronger than was forecast last summer.

As a reminder, US GDP data for May 2020 showed a drop of -5.7%. But since then, a series of stimulus packages totalling $3 trillion has been unleashed with most of it going directly to the consumer. In addition, President Joe Biden’s rescue plan is looking to add a further $1.9 trillion. The effect this could have on Q1 US GDP is hard to gauge but conservative estimates put the boost anywhere from +3.0% to +6.0% – (a huge forecast range by any measure that reflects the difficulty in measuring what is really going on). This would be in stark contrast to the Eurozone which could still be mired in negative growth of -3.0% or worse.

What is clear is that the US is bouncing back faster and stronger than was forecast last summer.

The EU has not stood by and done nothing, of course. Politicians hailed the EUR 750 billion Recovery Fund as a breakthrough and a historical moment following a fractious 5-day summit in July. But the package is more complex than the headlines suggest. It stretches over six years and is a mixture of grants and loans that come with conditions that vary from state to state. Typically, these will extend to austerity measures on spending, taxes and debt. Complying with these may actually be counter- productive to stimulating the economy.

By comparison, the US stimulus packages have put money directly into the pockets of US consumers. Data in May of last year showed a dramatic 33% rise in the US savings rate to a staggering $6 trillion. Coming as it did in the middle of the lockdown, this wasn’t terribly surprising since much of the service side of the economy was closed to the consumer. But as the summer progressed, and things started opening up again, it was found that a lot of the money had been used, particularly by the middle classes, to buy the stock market rather than, say, pay down debt.

In other words, that money is still available to be spent in a consumer boom when the economy is fully open. During the summer recovery, there was a notable shift in spending on goods away from groceries and into clothing and footwear; and in the service sector from mobile phones to travel. In the coming boom, it is expected that there could be an even bigger shift from goods to services – and this would have implications for inflation.

In both the US and UK some have predicted a return to the Roaring 20’s as pent-up demand is unleashed into their respective consumer economies. It sounds wonderful (!), but there are a few points to consider:

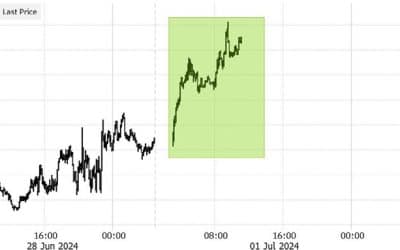

- Firstly, in the US, the stock market is now already 10% higher than before the pandemic and at record highs. A lot of the performance has come from the tech sector where valuations are very much higher than other in sectors. This can only reasonably be justified and supported by interest rates close to zero.

- Although we are likely to see a huge bounce back in GDP, there is no long-term correlation between GDP and stock markets. Imagine, for example, the impact to a company’s profits if it is forced to invest to meet growth stoked by a boom in consumer demand. What’s good for the consumer is not necessarily good for corporate profits in the short-term.

- Thirdly, and probably most importantly, is the possible reaction of the central banks.

Over the last decade or so, investors have got used to headline inflation remaining stubbornly low despite the main central banks adopting inflation targets north of 2% and initiating extraordinary levels of quantitative easing (QE). That’s not to say there was no inflation. There was plenty of it, but it was confined to assets – one only has to look at the stock, bond and property markets to see where the money went.

A Roaring 20’s consumer led inflation boom would be another matter entirely. We have already seen Global price increases in commodities while US survey data is also showing increasing price pressures and the future levels of inflation implied by index-linked bonds in the US demonstrate that inflation expectation are rising. So far this has merely manifested itself in record low yields for inflation-protected treasuries, but if inflation concerns persist, the yield curve will steepen further and real yields may rise. We are not expecting sustained inflation as there is still plenty of slack in the economy but we cannot be sure, and neither can the Fed. If inflation were to surge past the Federal Reserve’s target of 2.5%, it would severely test the assumption that the Fed will do nothing.

Actual interest hikes would be way down the line as Fed policy turns about as quickly as an oil tanker. But we can expect investors to scrutinise everything the Fed says for clues about a change in policy, particularly with regards to winding down QE. We have already seen statements from a few of the state Fed chiefs, including the respected Atlanta and Chicago heads, calling for QE to be scaled back.

This kind of talk is uncannily reminiscent of 2013 when the Federal Reserve Chairman, Ben Bernanke, announced their intention to gradually reduce, or taper, their monthly purchases of bonds which were serving to keep a lid on bond yields. Just the mere mention of it sent stock and bonds tumbling in what became known as the “taper tantrum”. The policy reversal never happened. Indeed, it went the other way with another round of QE totalling $1.5 trillion. But it had given investors a big wake-up call and Fed-watching became a full-time occupation.

It seems counter-intuitive to many that at a time when the Covid data is just starting to recover from the very worst, and there is a light at the end of the tunnel for jobs, wages and the economy, that there should be rising concerns for markets. But they are not easily dismissed. The fiscal give- away has been extraordinarily supportive during the economic shut-down. But if it is to be offset by monetary tightening, then it could have a profound effect on stock and bond markets, particularly assets trading at historic highs.

HELPLINE:

HELPLINE: